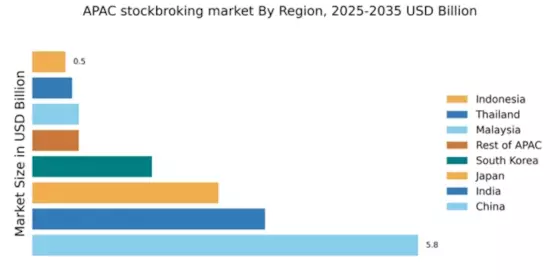

China : Rapid Growth and Innovation

China holds a commanding market share of 5.8% in the APAC stockbroking sector, driven by a burgeoning middle class and increasing digital adoption. Key growth drivers include government initiatives promoting financial literacy and investment, alongside a robust fintech ecosystem. Demand for online trading platforms is surging, supported by favorable regulatory policies that encourage foreign investment and enhance market accessibility. Infrastructure improvements, particularly in technology and internet connectivity, further bolster this growth.

India : Youthful Investors Driving Growth

India's stockbroking market accounts for 3.5% of the APAC total, reflecting a vibrant investment culture among its young population. The rise of mobile trading apps and government initiatives like the Financial Literacy Campaign are key growth drivers. Demand for equity investments is on the rise, fueled by increasing disposable incomes and a shift towards long-term wealth creation. Regulatory reforms aimed at simplifying the investment process are also enhancing market participation.

Japan : Innovation Meets Tradition

Japan's stockbroking market holds a 2.8% share in APAC, characterized by a blend of traditional investment practices and modern trading technologies. Key growth drivers include an aging population seeking retirement solutions and a government push for corporate governance reforms. Demand for diversified investment products is increasing, supported by regulatory frameworks that promote transparency and investor protection. The market is also witnessing a shift towards sustainable investing.

South Korea : Young Investors Embrace Digital Trading

South Korea's stockbroking market represents 1.8% of the APAC total, driven by a tech-savvy population and a strong digital infrastructure. The rise of mobile trading platforms and social trading communities are key growth drivers. Demand for innovative financial products is increasing, supported by government initiatives aimed at enhancing financial literacy. Regulatory policies are evolving to accommodate new fintech solutions, fostering a competitive environment.

Malaysia : Regulatory Reforms Boost Participation

Malaysia's stockbroking market accounts for 0.7% of the APAC share, with growth driven by regulatory reforms and increased retail investor participation. The government is promoting financial literacy and investment through various initiatives, which is enhancing demand for stock trading. Infrastructure improvements, particularly in digital banking, are also facilitating market access. However, challenges remain in terms of market volatility and investor confidence.

Thailand : Investment Culture on the Rise

Thailand's stockbroking market holds a 0.6% share in APAC, characterized by a growing investment culture among its citizens. Key growth drivers include government initiatives to promote stock market participation and increasing awareness of investment opportunities. Demand for online trading platforms is rising, supported by regulatory frameworks that encourage transparency. The competitive landscape features both local and international players, enhancing market dynamics.

Indonesia : Youthful Demographics Fuel Growth

Indonesia's stockbroking market represents 0.5% of the APAC total, with significant growth potential driven by a youthful population and increasing internet penetration. Government initiatives aimed at enhancing financial literacy and investment awareness are key growth drivers. Demand for accessible trading platforms is rising, supported by regulatory efforts to simplify the investment process. The competitive landscape is evolving, with both local and international firms entering the market.

Rest of APAC : Opportunities Across the Region

The Rest of APAC stockbroking market accounts for 0.7%, showcasing diverse investment landscapes across various countries. Key growth drivers include increasing financial literacy and government initiatives to promote stock market participation. Demand for innovative trading solutions is on the rise, supported by regulatory frameworks that encourage foreign investment. The competitive landscape varies significantly, with local players dominating in some areas while international firms lead in others.