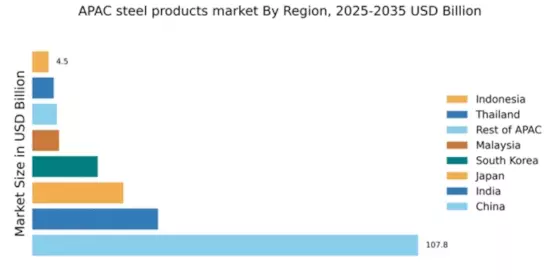

China : Unmatched Production and Demand Growth

Key markets include cities like Shanghai, Beijing, and Guangzhou, which are pivotal for steel consumption. The competitive landscape is dominated by major players such as China Baowu Steel Group and ArcelorMittal, which have established a strong foothold. Local dynamics are characterized by a robust supply chain and increasing investments in green steel technologies, catering to the construction and automotive industries.

India : Strong Growth in Infrastructure Demand

Key markets include Maharashtra, Gujarat, and Karnataka, where industrial hubs are rapidly developing. The competitive landscape features Tata Steel and Steel Authority of India Limited as major players. The business environment is evolving, with increasing foreign investments and a focus on modernizing production facilities, particularly in the construction and automotive sectors.

Japan : High-Quality Production and Exports

Key markets include Tokyo, Osaka, and Nagoya, which are central to steel consumption. The competitive landscape is led by Nippon Steel Corporation and JFE Holdings, known for their technological advancements. The local market dynamics favor high-value applications, particularly in automotive and machinery, with a strong emphasis on export-oriented production.

South Korea : Strong Demand from Automotive Sector

Key markets include Seoul and Busan, where major industrial activities are concentrated. The competitive landscape is dominated by POSCO and Hyundai Steel, which are leaders in high-quality steel production. The local business environment is favorable, with strong demand from the automotive and shipbuilding industries, driving innovation and efficiency in production.

Malaysia : Strategic Location for Trade and Industry

Key markets include Selangor and Penang, which are industrial hubs for steel consumption. The competitive landscape features local players alongside international firms, creating a dynamic market. The business environment is characterized by increasing investments in infrastructure projects, particularly in construction and manufacturing, which are key sectors for steel applications.

Thailand : Infrastructure Growth Fuels Demand

Key markets include Bangkok and Chonburi, where industrial activities are concentrated. The competitive landscape features local players and international firms, creating a diverse market. The business environment is evolving, with increasing foreign investments and a focus on modernizing production facilities, particularly in construction and automotive sectors.

Indonesia : Infrastructure Development Drives Growth

Key markets include Jakarta and Surabaya, which are central to steel consumption. The competitive landscape features local players alongside international firms, creating a dynamic market. The business environment is characterized by increasing investments in infrastructure projects, particularly in construction and manufacturing, which are key sectors for steel applications.

Rest of APAC : Varied Demand Across Sub-Regions

Key markets include Vietnam, Philippines, and Bangladesh, where industrial activities are growing. The competitive landscape features a mix of local and international players, creating a dynamic market. The business environment is evolving, with increasing investments in infrastructure projects, particularly in construction and manufacturing, which are key sectors for steel applications.