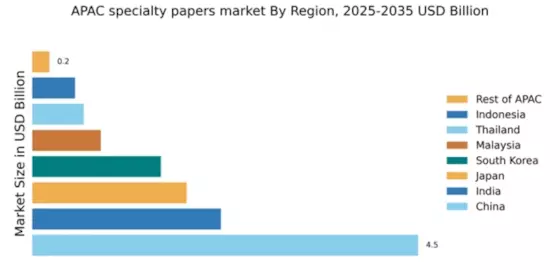

China : Unmatched Growth and Demand Trends

Key markets include major cities like Shanghai, Beijing, and Guangzhou, where demand for specialty papers is surging. The competitive landscape features significant players such as International Paper and Stora Enso, which are investing in local production facilities. The business environment is favorable, with a growing emphasis on innovation and quality. Industries such as food packaging, electronics, and publishing are primary consumers of specialty papers, driving local market dynamics.

India : Rapid Growth in Demand and Supply

Key markets include Maharashtra, Gujarat, and Tamil Nadu, where industrial hubs are thriving. The competitive landscape features players like Sappi Limited and WestRock Company, which are expanding their footprint in the region. The business environment is characterized by a mix of traditional and modern practices, with a growing emphasis on digital printing and eco-friendly products. The packaging and publishing industries are significant consumers of specialty papers, shaping local demand.

Japan : Technological Advancements Drive Growth

Key markets include Tokyo, Osaka, and Nagoya, where demand for high-quality specialty papers is robust. The competitive landscape features Nippon Paper Industries and UPM-Kymmene Corporation, which are leaders in innovation and quality. The business environment is highly competitive, with a focus on advanced manufacturing techniques. Industries such as electronics, automotive, and food packaging are primary consumers, influencing local market dynamics.

South Korea : Growth Driven by Packaging Needs

Key markets include Seoul, Busan, and Incheon, where demand for specialty papers is growing rapidly. The competitive landscape features major players like Mondi Group and Smurfit Kappa Group, which are expanding their operations in the region. The business environment is favorable, with a strong emphasis on innovation and quality. The packaging and publishing industries are significant consumers, shaping local demand dynamics.

Malaysia : Emerging Demand in Specialty Papers

Key markets include Kuala Lumpur, Selangor, and Penang, where demand for specialty papers is on the rise. The competitive landscape features local players and international companies like Sappi Limited, which are investing in production capabilities. The business environment is dynamic, with a focus on innovation and quality. The packaging and food industries are primary consumers, influencing local market trends.

Thailand : Specialty Papers for Diverse Industries

Key markets include Bangkok, Chonburi, and Nonthaburi, where demand for specialty papers is growing. The competitive landscape features local manufacturers and international players like Domtar Corporation, which are expanding their presence. The business environment is supportive, with a focus on quality and innovation. The packaging and publishing industries are significant consumers, shaping local market dynamics.

Indonesia : Rising Demand for Specialty Papers

Key markets include Jakarta, Surabaya, and Bandung, where demand for specialty papers is on the rise. The competitive landscape features local players and international companies, which are investing in production capabilities. The business environment is dynamic, with a focus on innovation and quality. The packaging and food industries are primary consumers, influencing local market trends.

Rest of APAC : Diverse Needs Across Sub-regions

Key markets include emerging economies where demand for specialty papers is growing. The competitive landscape features a mix of local and international players, each catering to specific market needs. The business environment varies significantly, with some regions focusing on traditional applications while others embrace innovation. Industries such as packaging and publishing are significant consumers, shaping local market dynamics.