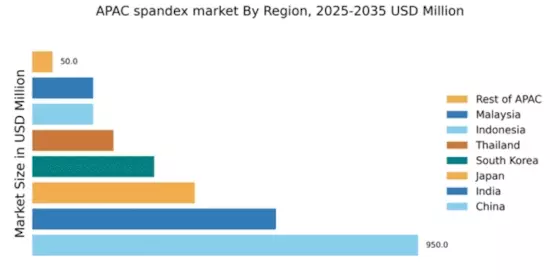

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 47.5% in the APAC spandex market, valued at $950.0 million. Key growth drivers include a booming textile industry, increasing demand for activewear, and government initiatives promoting sustainable manufacturing. Regulatory policies favoring eco-friendly production methods are also shaping consumption patterns. Infrastructure development, particularly in textile hubs like Zhejiang and Jiangsu, supports industrial growth and enhances supply chain efficiency.

India : Strong Demand from Fashion Industry

India accounts for 30% of the APAC spandex market, valued at $600.0 million. The growth is fueled by rising disposable incomes, urbanization, and a shift towards athleisure wear. Government initiatives like the Make in India program are boosting local manufacturing. The demand for spandex in activewear and swimwear is particularly strong, reflecting changing consumer preferences and lifestyle choices.

Japan : Focus on Quality and Technology

Japan holds a 20% share of the APAC spandex market, valued at $400.0 million. The market is driven by technological advancements in textile manufacturing and a strong emphasis on quality. Regulatory frameworks support innovation, particularly in sustainable materials. The demand for high-performance fabrics in sectors like sportswear and medical textiles is on the rise, reflecting Japan's focus on quality and functionality.

South Korea : Fashion-Forward Consumer Trends

South Korea represents 15% of the APAC spandex market, valued at $300.0 million. The growth is driven by a vibrant fashion industry and increasing consumer interest in fitness and wellness. Government policies promoting textile innovation and sustainability are enhancing market dynamics. Key cities like Seoul and Busan are central to spandex consumption, with a focus on high-quality, trendy activewear.

Malaysia : Strategic Location for Manufacturing

Malaysia captures 7.5% of the APAC spandex market, valued at $150.0 million. The market is growing due to its strategic location for manufacturing and export. Government initiatives to attract foreign investment in textiles are boosting local production. Demand for spandex in sportswear and casual clothing is increasing, driven by changing consumer lifestyles and preferences.

Thailand : Cultural Shift Towards Activewear

Thailand holds a 10% share of the APAC spandex market, valued at $200.0 million. The growth is attributed to a cultural shift towards fitness and active lifestyles. Government support for the textile industry and investments in infrastructure are enhancing market conditions. Key cities like Bangkok are witnessing increased demand for spandex in both fashion and functional apparel.

Indonesia : Youthful Demographics Driving Growth

Indonesia accounts for 7.5% of the APAC spandex market, valued at $150.0 million. The youthful population and rising middle class are key growth drivers. Government initiatives to improve textile manufacturing capabilities are also significant. The demand for spandex in casual and activewear is growing, reflecting changing consumer habits and preferences in urban areas like Jakarta.

Rest of APAC : Diverse Applications and Opportunities

The Rest of APAC holds a small share of 2.5%, valued at $50.0 million. This segment includes various smaller markets with unique demands. Growth is driven by niche applications in specialized textiles and local manufacturing initiatives. Regulatory support for sustainable practices is also emerging. Countries like Vietnam and the Philippines are beginning to show potential in spandex consumption, particularly in activewear and fashion sectors.