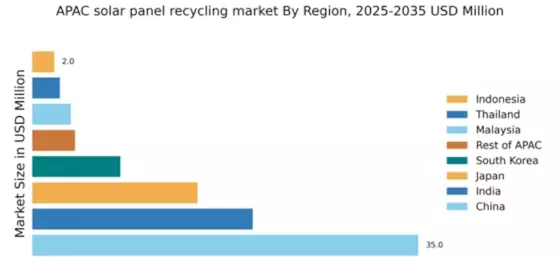

China : China's Dominance in Solar Recycling

China holds a commanding 35.0% market share in the APAC solar panel recycling sector, driven by rapid industrial growth and increasing environmental regulations. The demand for recycling is fueled by the country's ambitious renewable energy targets and government initiatives promoting sustainable practices. Infrastructure development, particularly in urban areas, supports the establishment of recycling facilities, enhancing operational efficiency and capacity.

India : India's Growing Solar Recycling Landscape

India accounts for 20.0% of the APAC solar panel recycling market, reflecting a burgeoning demand driven by the country's expanding solar energy capacity. Government policies, such as the National Solar Mission, encourage recycling initiatives, while increasing public awareness about sustainability fuels consumer demand. The growth of infrastructure, particularly in states like Gujarat and Rajasthan, is pivotal for recycling operations.

Japan : Japan's Advanced Recycling Technologies

Japan holds a 15.0% share in the APAC solar panel recycling market, characterized by its focus on innovative recycling technologies. The country's commitment to environmental sustainability is supported by stringent regulations and government incentives for recycling initiatives. Demand is driven by the increasing number of solar installations and a cultural emphasis on waste reduction and resource recovery.

South Korea : South Korea's Eco-Friendly Initiatives

With an 8.0% market share, South Korea is making strides in the solar panel recycling sector. The government has implemented policies to promote green technologies and recycling practices, aligning with its broader environmental goals. Urban centers like Seoul and Busan are key markets, where demand for recycling services is growing due to increased solar panel installations and public awareness of sustainability.

Malaysia : Malaysia's Solar Recycling Potential

Malaysia represents a 3.5% share in the APAC solar panel recycling market, with growth driven by increasing solar energy adoption and supportive government policies. The country's focus on renewable energy, particularly in states like Selangor and Penang, is fostering a conducive environment for recycling initiatives. Infrastructure development is crucial for enhancing recycling capabilities and meeting future demand.

Thailand : Thailand's Growing Recycling Sector

Thailand's solar panel recycling market accounts for 2.5%, with growth fueled by rising solar energy installations and government support for sustainable practices. The country's regulatory framework encourages recycling initiatives, particularly in urban areas like Bangkok. Local players are increasingly entering the market, enhancing competition and driving innovation in recycling technologies.

Indonesia : Indonesia's Untapped Recycling Market

Indonesia holds a 2.0% share in the APAC solar panel recycling market, with significant potential for growth. The increasing adoption of solar energy, supported by government initiatives, is driving demand for recycling services. Key markets include Jakarta and Bali, where urbanization and environmental awareness are on the rise, creating opportunities for local and international players.

Rest of APAC : Untapped Markets in Solar Recycling

The Rest of APAC accounts for 3.88% of the solar panel recycling market, showcasing diverse opportunities across various countries. Growth is driven by increasing solar energy adoption and varying regulatory frameworks that support recycling initiatives. Countries like Vietnam and the Philippines are emerging markets, with local players beginning to establish recycling operations to meet growing demand.