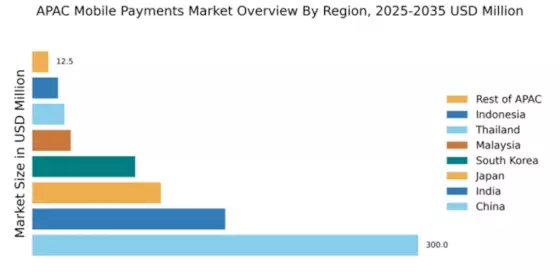

China : Unmatched Growth and Innovation

China holds a staggering 60% market share in the APAC mobile payments sector, valued at $300.0 billion. Key growth drivers include the rapid adoption of digital wallets, increasing smartphone penetration, and a tech-savvy population. Government initiatives like the Digital China strategy and supportive regulatory frameworks have fostered a conducive environment for mobile payment solutions. Infrastructure improvements, particularly in urban areas, have further accelerated demand for seamless payment experiences.

India : Digital Transformation in Finance

India commands a 15% market share, valued at $150.0 billion, driven by a surge in smartphone usage and government initiatives like Digital India. The UPI (Unified Payments Interface) has revolutionized transactions, making them faster and more accessible. Regulatory support from the Reserve Bank of India has also encouraged innovation in mobile payment solutions, while increasing financial literacy among consumers fuels demand.

Japan : A Blend of Tradition and Innovation

Japan's mobile payments market, valued at $100.0 billion, represents 10% of the APAC share. The growth is propelled by the integration of mobile wallets with traditional banking systems and a strong consumer preference for contactless payments. Government initiatives promoting cashless transactions and the 2020 Tokyo Olympics have further accelerated adoption. The country's advanced infrastructure supports seamless payment experiences across urban centers.

South Korea : Innovative Payment Technologies

South Korea holds an 8% market share, valued at $80.0 billion, characterized by a strong inclination towards contactless payments. The government’s push for a cashless society, along with high smartphone penetration, has driven the adoption of mobile payment solutions. Major cities like Seoul and Busan are at the forefront of this trend, with significant investments in fintech and digital infrastructure enhancing user experiences.

Malaysia : Growth in Digital Transactions

Malaysia's mobile payments market, valued at $30.0 billion, accounts for 3% of the APAC share. The growth is fueled by increasing smartphone adoption and government initiatives aimed at promoting cashless transactions. The Malaysian government’s Digital Economy Blueprint supports fintech innovation, while urban centers like Kuala Lumpur are witnessing a rise in mobile payment adoption among consumers and businesses alike.

Thailand : Mobile Payments on the Rise

Thailand's mobile payments market, valued at $25.0 billion, represents 2.5% of the APAC share. The growth is significantly driven by the tourism sector, with international visitors preferring cashless transactions. Government initiatives to promote digital payments and the increasing penetration of smartphones are also key factors. Cities like Bangkok and Phuket are leading in mobile payment adoption, supported by a growing fintech ecosystem.

Indonesia : Mobile Payments Gaining Traction

Indonesia's mobile payments market, valued at $20.0 billion, accounts for 2% of the APAC share. The rapid growth is driven by a young population and increasing smartphone penetration. Government initiatives to enhance financial inclusion and the rise of e-commerce are significant growth drivers. Key cities like Jakarta and Surabaya are witnessing a surge in mobile payment adoption, with local players like Gojek and OVO leading the market.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC holds a market share of 1.25%, valued at $12.5 billion. This segment includes diverse markets with varying levels of mobile payment adoption. Growth is driven by increasing internet penetration and government initiatives to promote digital payments. However, challenges such as regulatory hurdles and infrastructure gaps persist. Countries like Vietnam and the Philippines are emerging markets with potential for growth in mobile payments.