Government Initiatives and Support

Government initiatives play a crucial role in shaping the mobile payments market in Japan. The Japanese government has actively promoted cashless transactions to enhance economic efficiency and reduce the reliance on physical currency. Initiatives such as the 'Cashless Vision' aim to increase cashless payment transactions to 40% by 2025. This policy framework encourages businesses to adopt mobile payment solutions, thereby expanding the market. Furthermore, the government has introduced subsidies for small and medium enterprises to facilitate the integration of mobile payment systems. Such support is likely to bolster the mobile payments market, fostering a more inclusive financial ecosystem.

Rise of E-commerce and Online Shopping

The rise of e-commerce and online shopping is a pivotal driver for the mobile payments market in Japan. With the increasing number of consumers engaging in online retail, the demand for efficient and secure payment methods has escalated. In 2025, e-commerce sales in Japan are projected to reach ¥20 trillion, with a substantial portion of these transactions being conducted via mobile payment platforms. This trend indicates a shift towards digital transactions, as consumers seek seamless payment experiences. Consequently, the mobile payments market is likely to expand, catering to the needs of online shoppers and enhancing the overall digital shopping experience.

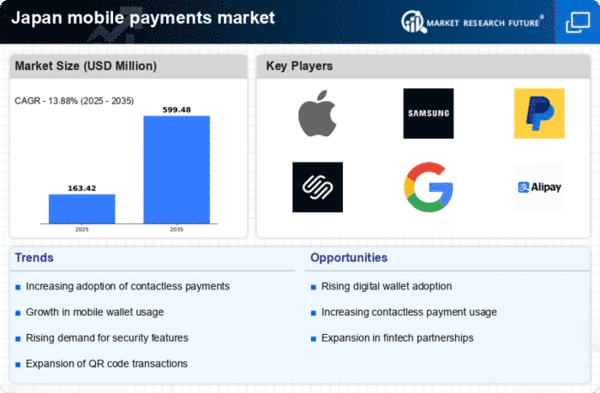

Technological Advancements in Payment Systems

The mobile payments market in Japan is experiencing a surge due to rapid technological advancements in payment systems. Innovations such as Near Field Communication (NFC) and QR code scanning have streamlined transaction processes, making them faster and more efficient. As of 2025, approximately 70% of Japanese consumers utilize mobile payment applications, reflecting a growing acceptance of digital wallets. This trend is further supported by the increasing penetration of smartphones, with over 90% of the population owning a mobile device. The mobile payments market is thus poised for continued growth as technology evolves, enabling seamless transactions and enhancing user experience.

Increased Focus on Security and Fraud Prevention

As the mobile payments market in Japan continues to grow, there is an increased focus on security and fraud prevention measures. Consumers are becoming more aware of potential risks associated with digital transactions, prompting payment providers to enhance their security protocols. The implementation of biometric authentication and advanced encryption technologies is becoming commonplace, instilling confidence among users. Reports suggest that 75% of consumers consider security a top priority when choosing a mobile payment method. This emphasis on security is likely to drive the mobile payments market forward, as trust in digital payment solutions is essential for sustained growth.

Consumer Behavior Shifts Towards Digital Payments

Shifts in consumer behavior are significantly influencing the mobile payments market in Japan. A growing preference for convenience and speed in transactions has led to an increased adoption of mobile payment solutions. Surveys indicate that over 60% of consumers prefer using mobile payments for everyday purchases, citing ease of use and time-saving benefits. This behavioral change is further driven by the younger demographic, who are more inclined to embrace digital solutions. As a result, the mobile payments market is adapting to meet these evolving consumer expectations, leading to the development of user-friendly applications and enhanced functionalities.