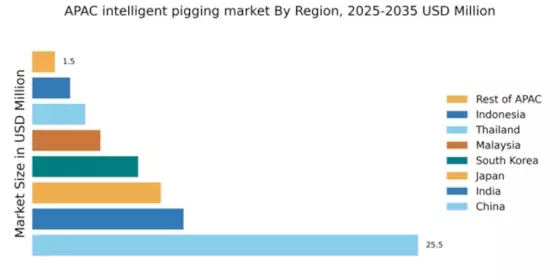

China : Robust Growth Driven by Infrastructure

China holds a commanding 25.5% market share in the intelligent pigging sector, valued at approximately $1.5 billion. Key growth drivers include rapid industrialization, increasing pipeline infrastructure, and stringent safety regulations. The government has initiated several policies to enhance pipeline safety and efficiency, fostering demand for intelligent pigging solutions. Additionally, the push for energy efficiency and environmental sustainability is driving consumption patterns towards advanced inspection technologies.

India : Growing Demand in Energy Sector

India's intelligent pigging market accounts for 10.0% of the APAC share, valued at around $600 million. The growth is fueled by increasing investments in oil and gas infrastructure, alongside government initiatives like the Pradhan Mantri Ujjwala Yojana aimed at enhancing energy access. Demand trends indicate a shift towards advanced inspection technologies, driven by the need for pipeline integrity and safety compliance. Regulatory frameworks are evolving to support these advancements.

Japan : Focus on Safety and Innovation

Japan captures 8.5% of the intelligent pigging market, valued at approximately $500 million. The market is driven by stringent safety regulations and a focus on technological innovation in pipeline maintenance. The government promotes initiatives to enhance energy efficiency and reduce environmental impact, which boosts demand for intelligent pigging solutions. Consumption patterns reflect a preference for high-tech inspection methods, aligning with Japan's advanced industrial capabilities.

South Korea : Investment in Energy Infrastructure

South Korea holds a 7.0% market share in the intelligent pigging sector, valued at about $400 million. Key growth drivers include significant investments in energy infrastructure and a strong regulatory framework promoting pipeline safety. The government has implemented policies to enhance energy security, which is increasing demand for intelligent pigging technologies. Consumption trends show a rising preference for automated inspection solutions to ensure compliance and efficiency.

Malaysia : Focus on Oil and Gas Sector

Malaysia's intelligent pigging market represents 4.5% of the APAC share, valued at around $250 million. The growth is driven by the oil and gas sector's expansion and government initiatives to improve pipeline safety standards. Demand trends indicate a growing reliance on intelligent pigging for maintenance and compliance. Regulatory policies are evolving to support technological advancements, while infrastructure development is crucial for market growth.

Thailand : Government Support for Energy Sector

Thailand accounts for 3.5% of the intelligent pigging market, valued at approximately $200 million. The market is driven by government support for energy sector development and increasing investments in pipeline infrastructure. Demand trends reflect a growing awareness of the importance of pipeline integrity and safety. Regulatory frameworks are being strengthened to promote the adoption of intelligent pigging technologies, enhancing market dynamics.

Indonesia : Focus on Infrastructure Development

Indonesia's intelligent pigging market holds a 2.5% share, valued at around $150 million. The growth is driven by ongoing infrastructure development and increasing investments in the oil and gas sector. Demand trends indicate a rising need for efficient pipeline inspection solutions to ensure safety and compliance. Government initiatives are aimed at enhancing energy security, which is fostering a favorable business environment for intelligent pigging technologies.

Rest of APAC : Diverse Applications Across Industries

The Rest of APAC accounts for 1.5% of the intelligent pigging market, valued at approximately $100 million. This sub-region includes various countries with unique market dynamics and applications in sectors like water, gas, and oil. Growth is driven by increasing awareness of pipeline safety and the need for compliance with international standards. Local market conditions vary, but there is a collective push towards adopting advanced inspection technologies.