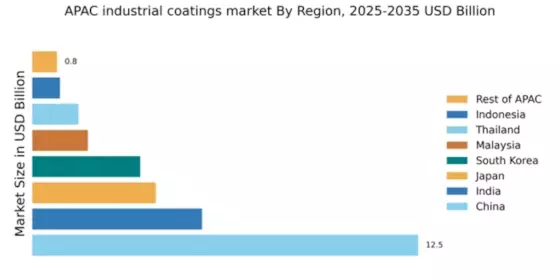

China : Unmatched Growth and Demand Trends

China holds a commanding 12.5% market share in the APAC industrial coatings sector, driven by rapid urbanization and industrialization. Key growth drivers include government initiatives promoting infrastructure development and stringent environmental regulations that encourage the use of eco-friendly coatings. The demand for high-performance coatings is rising, particularly in construction and automotive sectors, as manufacturers seek durability and sustainability in their products. Regulatory policies are increasingly favoring low-VOC and water-based coatings, aligning with global sustainability trends.

India : Rapid Growth in Industrial Sectors

India's industrial coatings market accounts for 5.5% of the APAC total, reflecting a burgeoning demand driven by the automotive and construction industries. The government's push for 'Make in India' has spurred local manufacturing, increasing the need for protective coatings. Additionally, rising disposable incomes and urbanization are fueling consumption patterns. Regulatory frameworks are evolving to support sustainable practices, enhancing the appeal of eco-friendly coatings.

Japan : Technological Advancements in Coatings

Japan's industrial coatings market represents 4.0% of the APAC share, characterized by a strong emphasis on innovation and quality. The automotive and electronics sectors are primary consumers, driving demand for advanced coatings that offer superior performance. Government initiatives promoting research and development in sustainable materials are pivotal. The market is also influenced by stringent regulations on VOC emissions, pushing manufacturers towards greener alternatives.

South Korea : Strong Demand from Electronics Industry

South Korea holds a 3.5% share in the industrial coatings market, with significant contributions from the electronics and automotive sectors. The demand for high-performance coatings is driven by technological advancements and a focus on product durability. Government policies supporting innovation and sustainability are shaping the market landscape. The competitive environment features major players like AkzoNobel and PPG Industries, who are investing in local production facilities.

Malaysia : Strategic Location for Manufacturing

Malaysia's industrial coatings market, accounting for 1.8% of APAC, is witnessing growth due to its strategic location and robust manufacturing sector. Key growth drivers include increasing investments in infrastructure and a rising demand for protective coatings in various industries, including oil and gas. Government initiatives aimed at enhancing manufacturing capabilities are also significant. The market is characterized by a mix of local and international players, fostering a competitive landscape.

Thailand : Key Player in ASEAN Region

Thailand's industrial coatings market represents 1.5% of the APAC total, benefiting from its position as a manufacturing hub in the ASEAN region. The automotive and construction sectors are primary consumers, driving demand for high-quality coatings. Government policies promoting exports and foreign investments are enhancing market dynamics. Major players like BASF and Nippon Paint Holdings are well-established, contributing to a competitive environment focused on innovation and sustainability.

Indonesia : Rising Demand in Construction Sector

Indonesia's industrial coatings market, with a 0.9% share, is on the rise, driven by increasing construction activities and urbanization. The demand for protective coatings is growing as infrastructure projects expand. Government initiatives aimed at improving the business environment and attracting foreign investments are crucial for market growth. The competitive landscape includes both local and international players, with a focus on cost-effective and sustainable solutions.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 0.8% of the industrial coatings market, characterized by diverse economic conditions and varying demand trends. Growth is influenced by local industries, including construction and manufacturing, which differ significantly across countries. Regulatory environments are also diverse, impacting market dynamics. The competitive landscape features a mix of regional players and global companies, each adapting to local market needs and preferences.