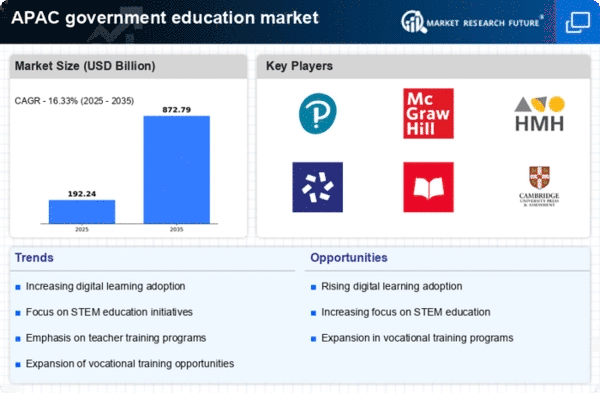

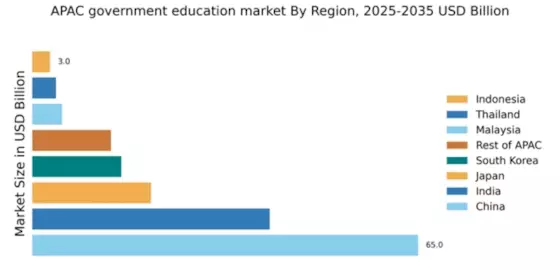

China : Unmatched Growth and Investment Opportunities

China holds a staggering 65.0% market share in the APAC education sector, valued at approximately $30 billion. Key growth drivers include government initiatives like the New Education Reform, which emphasizes digital learning and vocational training. The demand for quality education is surging, driven by urbanization and a growing middle class. Regulatory policies support increased investment in educational infrastructure, enhancing the overall learning environment.

India : Diverse Needs and Digital Transformation

India's education market commands a 40.0% share, valued at around $15 billion. The growth is fueled by rising enrollment rates and a shift towards online learning platforms. Government initiatives like the National Education Policy 2020 aim to improve educational access and quality. The increasing demand for skill-based education and vocational training is reshaping consumption patterns, with a focus on technology integration.

Japan : Balancing Tradition with Modernity

Japan's education market holds a 20.0% share, valued at approximately $10 billion. The growth is driven by a strong emphasis on STEM education and government support for digital learning initiatives. The demand for personalized learning experiences is rising, influenced by cultural values that prioritize education. Regulatory frameworks encourage collaboration between educational institutions and technology providers.

South Korea : Leading in Digital Learning Integration

South Korea captures a 15.0% market share, valued at around $7 billion. The country's focus on technology in education, supported by government policies, drives growth. The demand for e-learning and mobile education solutions is increasing, reflecting changing consumption patterns. Initiatives like the Smart Education Policy promote innovative teaching methods and digital resources.

Malaysia : Investing in Future Generations

Malaysia's education market represents a 5.0% share, valued at approximately $2 billion. Growth is driven by government initiatives aimed at enhancing educational quality and accessibility. The demand for international schools and vocational training is rising, influenced by a diverse population. Regulatory policies support foreign investment in the education sector, fostering a competitive landscape.

Thailand : Focus on Quality and Accessibility

Thailand holds a 4.0% market share, valued at around $1.5 billion. The growth is supported by government initiatives to improve educational standards and accessibility. The demand for English language education and vocational training is increasing, reflecting changing job market needs. Regulatory frameworks encourage partnerships between public and private sectors to enhance educational offerings.

Indonesia : Investments in Infrastructure and Access

Indonesia's education market accounts for a 3.0% share, valued at approximately $1 billion. Key growth drivers include government efforts to improve educational infrastructure and access to quality education. The rising demand for digital learning solutions is reshaping consumption patterns. Regulatory policies support the establishment of private educational institutions, enhancing competition.

Rest of APAC : Navigating Varied Educational Landscapes

The Rest of APAC holds a 13.25% market share, valued at around $5 billion. Growth is driven by varying educational needs across countries, influenced by local cultures and economies. Government initiatives focus on improving educational access and quality. The competitive landscape includes both local and international players, with a focus on tailored educational solutions to meet diverse demands.