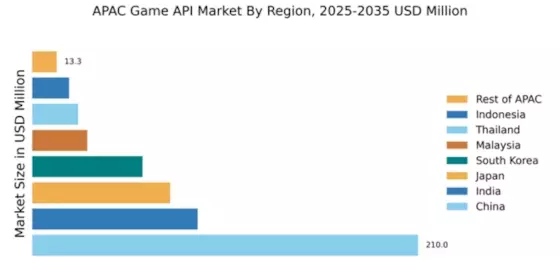

China : Unmatched Growth and Innovation

China holds a commanding market share of 210.0, representing a significant portion of the APAC game API market. Key growth drivers include a booming gaming industry, increasing mobile penetration, and government support for tech innovation. Demand trends show a shift towards mobile and cloud gaming, with regulatory policies favoring local developers. Infrastructure improvements, particularly in 5G technology, are enhancing user experiences and driving consumption patterns.

India : Rapid Growth and Diverse Audience

Cities like Bengaluru, Hyderabad, and Pune are pivotal in the gaming ecosystem. The competitive landscape features major players like Tencent and local startups. The business environment is vibrant, with a focus on mobile and casual gaming. The presence of tech hubs and incubators is nurturing innovation, while the eSports sector is gaining traction, further diversifying the market.

Japan : Cultural Richness Meets Technology

Tokyo and Osaka are key markets, hosting major gaming companies like Sony Interactive Entertainment. The competitive landscape is robust, with both local and international players vying for market share. The business environment is favorable, with a focus on AR/VR applications and mobile gaming. The presence of established franchises and a growing eSports scene are also significant.

South Korea : High Engagement and Innovation

Seoul is the epicenter of the gaming industry, with major players like Nexon and NCSoft leading the market. The competitive landscape is dynamic, with a mix of local and international companies. The business environment is conducive to innovation, with a focus on mobile and online gaming. The eSports sector is particularly vibrant, attracting global attention and investment.

Malaysia : Diverse Audience and Opportunities

Kuala Lumpur and Penang are key markets, with a growing number of local developers and startups. The competitive landscape features both local and international players, fostering a collaborative environment. The business climate is improving, with a focus on mobile gaming and educational applications. The presence of tech incubators is also nurturing innovation in the gaming sector.

Thailand : Cultural Influence and Growth

Bangkok is a key market, hosting a mix of local developers and international companies. The competitive landscape is evolving, with a focus on mobile gaming and eSports. The business environment is becoming more favorable, with increasing investment in gaming startups. Local cultural influences are shaping game content, making it more relatable to the audience.

Indonesia : Youthful Demographics and Innovation

Jakarta and Bandung are key markets, with a growing number of local game developers. The competitive landscape features both local startups and international players, creating a dynamic environment. The business climate is improving, with a focus on mobile and casual gaming. The rise of eSports is also contributing to market growth, attracting investment and interest from global players.

Rest of APAC : Varied Growth Across Regions

Countries like Vietnam, Philippines, and Singapore are emerging markets with unique characteristics. The competitive landscape is fragmented, with a mix of local and international players. The business environment is diverse, with varying levels of investment and infrastructure development. Local gaming preferences are shaping content, leading to innovative applications tailored to specific audiences.