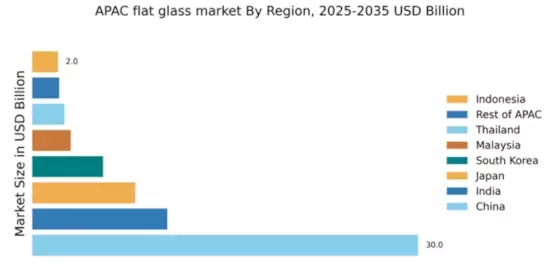

China : Unmatched Growth and Demand Trends

China holds a commanding 30.0% market share in the APAC flat glass sector, valued at approximately $15 billion. Key growth drivers include rapid urbanization, increasing construction activities, and a surge in automotive production. Government initiatives promoting energy-efficient buildings and stringent regulations on glass quality further bolster demand. Infrastructure projects, such as the Belt and Road Initiative, are enhancing industrial development, creating a robust market environment.

India : Rapid Urbanization Fuels Demand

India's flat glass market accounts for 10.5% of the APAC share, valued at around $5 billion. The growth is driven by increasing construction activities, particularly in residential and commercial sectors. Government initiatives like the Smart Cities Mission and Make in India are enhancing infrastructure and promoting local manufacturing. The demand for energy-efficient glass solutions is also on the rise, reflecting changing consumer preferences.

Japan : Quality and Precision Define Market

Japan holds an 8.0% share in the APAC flat glass market, valued at approximately $4 billion. The market is driven by technological advancements in glass manufacturing and a strong focus on quality. Demand is particularly high in the automotive and electronics sectors, where precision is crucial. Government regulations promoting energy efficiency and sustainability are also influencing consumption patterns, pushing for innovative glass solutions.

South Korea : Key Player in High-Tech Applications

South Korea's flat glass market represents 5.5% of the APAC share, valued at about $2.5 billion. The growth is primarily driven by the electronics industry, where high-quality glass is essential for displays and screens. Government support for technology-driven industries and investments in R&D are fostering innovation. The competitive landscape includes major players like AGC Inc. and local firms, enhancing market dynamics.

Malaysia : Sustainable Solutions in Construction

Malaysia's flat glass market accounts for 3.0% of the APAC share, valued at approximately $1.5 billion. The market is driven by increasing demand for architectural glass in residential and commercial buildings. Government initiatives promoting green building practices and energy-efficient solutions are shaping consumption trends. The competitive landscape features both local and international players, contributing to a dynamic business environment.

Thailand : Gateway to ASEAN Markets

Thailand holds a 2.5% share in the APAC flat glass market, valued at around $1 billion. The country serves as a strategic manufacturing hub for the ASEAN region, benefiting from favorable trade agreements. Key growth drivers include rising construction activities and government support for infrastructure projects. The competitive landscape includes both local manufacturers and international players, enhancing market dynamics.

Indonesia : Investment in Construction Sector

Indonesia's flat glass market represents 2.0% of the APAC share, valued at approximately $800 million. The growth is driven by significant investments in infrastructure and housing projects. Government initiatives aimed at improving urban infrastructure are boosting demand for flat glass. The competitive landscape features both local and international players, with a focus on meeting the growing needs of the construction sector.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC accounts for 2.1% of the flat glass market, valued at around $900 million. This segment includes various countries with diverse market needs and consumption patterns. Growth is driven by regional infrastructure projects and increasing urbanization. The competitive landscape varies significantly, with local players dominating in some areas while international firms lead in others, creating a unique market environment.