Strategic Trade Agreements

The ethane market in APAC is benefiting from strategic trade agreements among member countries. These agreements facilitate the free flow of ethane and its derivatives across borders, enhancing market accessibility and competitiveness. For instance, recent trade agreements between ASEAN nations have reduced tariffs on ethane imports, making it more economically viable for countries with limited domestic production. This increased trade activity is likely to stimulate the ethane market by allowing countries to optimize their resources and meet local demand more effectively. Additionally, these agreements may encourage collaboration in research and development, further advancing the technological landscape of the ethane market.

Growing Demand for Ethylene

The ethane market in APAC is significantly influenced by the growing demand for ethylene, a primary derivative of ethane. Ethylene is widely utilized in the production of plastics, synthetic fibers, and other chemicals. The demand for ethylene is projected to grow at a CAGR of around 6% over the next five years, driven by the increasing consumption of plastic products in emerging economies. This surge in ethylene demand is likely to enhance the consumption of ethane as a feedstock, thereby positively impacting the ethane market. Additionally, the shift towards sustainable materials may further drive the need for ethylene, as manufacturers seek to produce eco-friendly alternatives, thus creating new opportunities within the ethane market.

Rising Environmental Awareness

The ethane market in APAC is increasingly shaped by rising environmental awareness among consumers and industries. As governments implement stricter regulations on emissions and promote cleaner energy sources, the demand for ethane as a cleaner alternative to coal and oil is likely to rise. Ethane, being a cleaner-burning fossil fuel, is seen as a viable option for reducing greenhouse gas emissions. This shift in consumer preference is expected to drive the adoption of ethane in various applications, including power generation and heating. Consequently, the ethane market may experience growth as industries seek to comply with environmental standards while meeting energy demands.

Increased Ethane Production Capacity

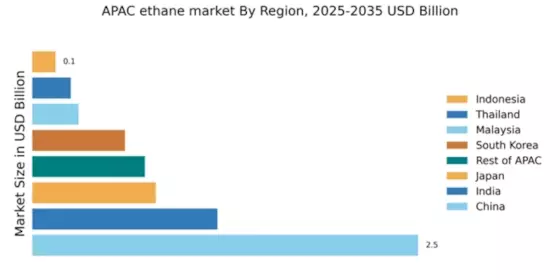

The ethane market in APAC is experiencing a notable increase in production capacity, driven by the expansion of natural gas processing facilities. Countries like China and India are investing heavily in infrastructure to enhance ethane extraction from natural gas. This expansion is projected to boost ethane production by approximately 15% annually, meeting the rising demand from the petrochemical sector. The increased availability of ethane is likely to support the growth of the ethane market, as it serves as a key feedstock for ethylene production. Furthermore, the establishment of new processing plants is expected to create job opportunities and stimulate local economies, thereby reinforcing the overall market dynamics in the region.

Investment in Petrochemical Projects

The ethane market in APAC is witnessing a surge in investments directed towards petrochemical projects. Major players are committing substantial capital to develop new facilities and expand existing ones, with investments exceeding $10 billion in the last year alone. This influx of capital is expected to enhance the production capabilities of ethane derivatives, particularly ethylene and polyethylene. As a result, the ethane market is likely to benefit from improved economies of scale and reduced production costs. Furthermore, these investments are anticipated to foster technological advancements, leading to more efficient extraction and processing methods, which could further bolster the market's growth trajectory.