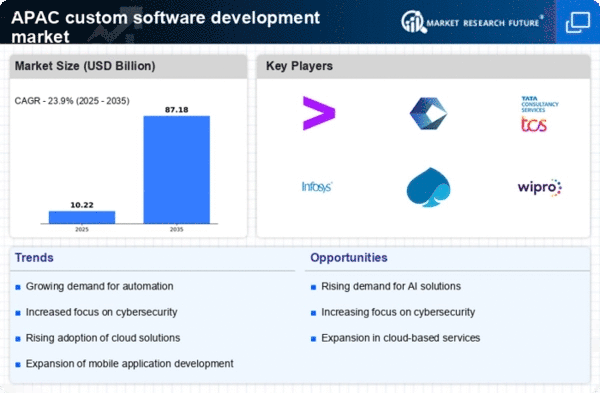

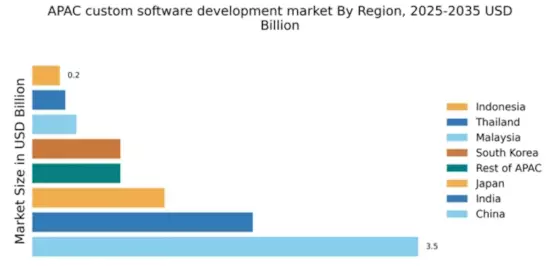

China : Rapid Growth and Innovation Hub

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are home to numerous tech firms and startups. The competitive landscape features significant players such as Alibaba Cloud, Tencent, and Huawei, alongside global firms like Accenture and IBM. The local business environment is characterized by rapid technological adoption and a focus on sectors like e-commerce, fintech, and smart manufacturing, driving demand for customized software solutions.

India : Innovation and Talent Abundance

Key markets include Bengaluru, Hyderabad, and Pune, which are recognized as tech innovation centers. The competitive landscape is dominated by major players such as Tata Consultancy Services, Infosys, and Wipro, alongside global firms like Cognizant. The local market dynamics are characterized by a strong focus on sectors like e-commerce, healthcare, and finance, driving demand for tailored software solutions.

Japan : Strong Demand for Custom Solutions

Tokyo and Osaka are key markets, hosting numerous tech firms and startups. The competitive landscape features major players like Fujitsu and NEC, alongside global firms such as IBM and Capgemini. The local business environment is characterized by a demand for precision and quality, particularly in sectors like automotive, robotics, and healthcare, which require customized software solutions.

South Korea : Tech-Driven Market Growth

Seoul and Busan are key markets, with a vibrant tech ecosystem. Major players include Samsung SDS and LG CNS, alongside global firms like Accenture and IBM. The competitive landscape is characterized by a focus on sectors such as gaming, telecommunications, and smart cities, driving demand for customized software solutions tailored to local needs.

Malaysia : Emerging Market for Software Solutions

Kuala Lumpur and Penang are key markets, with a growing number of tech startups and established firms. The competitive landscape features local players like Fusionex and global firms such as Accenture. The local business environment is characterized by a focus on sectors like e-commerce, finance, and education, driving demand for customized software solutions.

Thailand : Evolving Software Development Landscape

Bangkok and Chiang Mai are key markets, with a growing number of tech startups and established firms. The competitive landscape features local players like Advanced Info Service and global firms such as IBM. The local business environment is characterized by a focus on sectors like tourism, finance, and retail, driving demand for customized software solutions.

Indonesia : Emerging Market Potential

Jakarta and Bandung are key markets, with a burgeoning tech startup scene. The competitive landscape features local players like Gojek and Tokopedia, alongside global firms such as Accenture. The local business environment is characterized by a focus on sectors like e-commerce, fintech, and logistics, driving demand for customized software solutions.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Singapore, Vietnam, and the Philippines, each with unique tech ecosystems. The competitive landscape features a mix of local and global players, including firms like Grab and Alibaba. The local business environment is characterized by diverse sector demands, including e-commerce, healthcare, and education, driving the need for customized software solutions.