Emphasis on Safety and Compliance

The construction software market in APAC is increasingly influenced by the emphasis on safety and compliance regulations. With the construction industry facing heightened scrutiny regarding safety standards, companies are turning to software solutions that help monitor compliance with local regulations. This trend is particularly evident in countries like Japan and Australia, where strict safety protocols are enforced. The market for compliance management software is projected to grow significantly, as firms seek to mitigate risks and avoid costly penalties. By leveraging technology to ensure adherence to safety standards, construction companies can enhance their reputation and operational efficiency. Thus, the construction software market in APAC is likely to benefit from the growing focus on safety and compliance measures.

Rising Infrastructure Investments

The construction software market in APAC is experiencing a surge due to increased investments in infrastructure development. Governments across the region are allocating substantial budgets for projects such as transportation networks, urban development, and public facilities. For instance, the Asian Development Bank has projected that infrastructure investments in APAC could reach $26 trillion by 2030. This influx of capital is likely to drive demand for construction software solutions that enhance project management, cost estimation, and resource allocation. As construction firms seek to optimize their operations and improve efficiency, the adoption of advanced software tools becomes essential. Consequently, the construction software market in APAC is poised for significant growth as stakeholders aim to meet the rising demands of infrastructure projects.

Emergence of Smart Construction Practices

The construction software market in APAC is being shaped by the emergence of smart construction practices, which leverage technology to enhance efficiency and sustainability. The integration of IoT, AI, and data analytics into construction processes is transforming traditional methods. For example, smart sensors can monitor equipment performance and environmental conditions, leading to proactive maintenance and reduced downtime. The market for smart construction solutions is projected to grow as companies seek to optimize resource utilization and minimize waste. This trend aligns with the broader push for sustainable construction practices in APAC, where environmental concerns are becoming increasingly prominent. As a result, the construction software market in APAC is likely to expand as firms adopt smart technologies to improve their operations.

Adoption of Building Information Modeling (BIM)

The construction software market in APAC is experiencing a notable shift towards the adoption of Building Information Modeling (BIM) technologies. BIM facilitates improved collaboration among architects, engineers, and contractors by providing a shared digital representation of a project. This technology is becoming increasingly essential as construction projects grow in complexity and scale. The market for BIM software is expected to expand as stakeholders recognize its potential to reduce errors, enhance visualization, and streamline workflows. In APAC, countries such as Singapore and South Korea are leading the way in BIM adoption, with government initiatives promoting its use in public projects. Consequently, the construction software market in APAC is likely to see substantial growth driven by the integration of BIM technologies.

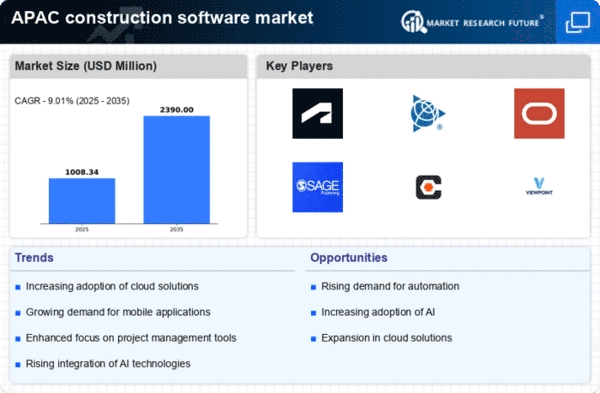

Growing Demand for Project Management Solutions

The construction software market in APAC is witnessing a growing demand for project management solutions. As construction projects become increasingly complex, stakeholders require tools that facilitate better planning, scheduling, and collaboration. The market for project management software is expected to grow at a CAGR of approximately 10% over the next five years. This growth is driven by the need for real-time data access and communication among project teams, which enhances decision-making and reduces delays. Furthermore, the integration of mobile applications allows on-site personnel to access project information instantly, thereby improving overall productivity. As a result, the construction software market in APAC is likely to expand as companies invest in robust project management solutions to streamline their operations.