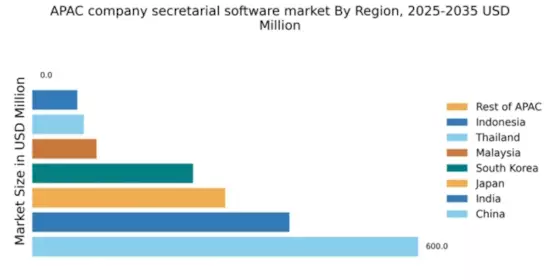

China : Robust Growth and Innovation

China holds a commanding market share of 60% in the company secretarial software sector, valued at $600.0 million. Key growth drivers include rapid digital transformation, increasing regulatory compliance requirements, and a burgeoning corporate sector. The Chinese government has implemented supportive policies to enhance digital infrastructure, fostering a conducive environment for software adoption. Additionally, the rise of e-governance initiatives is driving demand for efficient secretarial solutions.

India : Rapid Growth and Adoption Trends

India's market share stands at 40% with a value of $400.0 million, driven by a surge in startups and SMEs seeking efficient compliance solutions. The government's push for 'Digital India' has accelerated the adoption of technology in corporate governance. Demand is particularly strong in urban centers like Bangalore and Mumbai, where tech-savvy businesses are prevalent. Regulatory frameworks are evolving to support digital solutions, enhancing market potential.

Japan : Innovation Meets Tradition

Japan accounts for a 30% market share, valued at $300.0 million. The growth is fueled by a strong emphasis on corporate governance and compliance, alongside a shift towards digital solutions. The government has introduced initiatives to promote digital transformation in businesses, particularly in sectors like finance and manufacturing. Japanese firms are increasingly adopting software to streamline secretarial tasks and enhance operational efficiency.

South Korea : Dynamic Market with High Standards

South Korea holds a 25% market share, valued at $250.0 million. The market is driven by stringent regulatory requirements and a high level of corporate governance. The government has been proactive in promoting digital solutions, with initiatives aimed at enhancing transparency and efficiency in corporate operations. Major cities like Seoul and Busan are key markets, where demand for innovative software solutions is robust.

Malaysia : Emerging Market with Potential

Malaysia's market share is 10%, valued at $100.0 million. The growth is supported by increasing awareness of corporate governance and compliance among businesses. The Malaysian government has introduced policies to encourage digital transformation, particularly in the SME sector. Demand is rising in urban areas like Kuala Lumpur, where businesses are seeking efficient secretarial solutions to meet regulatory requirements.

Thailand : Focus on Digital Transformation

Thailand's market share is 8%, valued at $80.0 million. The market is experiencing growth due to increasing regulatory compliance needs and a shift towards digital solutions. The Thai government is promoting initiatives to enhance the digital economy, which is driving demand for software solutions. Key markets include Bangkok and Chiang Mai, where businesses are increasingly adopting technology for secretarial tasks.

Indonesia : Focus on Compliance and Efficiency

Indonesia holds a 7% market share, valued at $70.0 million. The growth is driven by a rising number of businesses seeking efficient compliance solutions amid increasing regulatory scrutiny. The Indonesian government is implementing policies to support digital transformation, particularly in urban areas like Jakarta. The competitive landscape is evolving, with local and international players vying for market share.

Rest of APAC : Exploring New Opportunities

The Rest of APAC shows minimal market activity, with a share of 0%. However, there is significant potential for growth as digital transformation initiatives gain traction across various countries. Emerging markets are beginning to recognize the importance of compliance and governance, creating opportunities for software providers. As infrastructure improves, demand for company secretarial solutions is expected to rise in these regions.