Rising Regulatory Demands

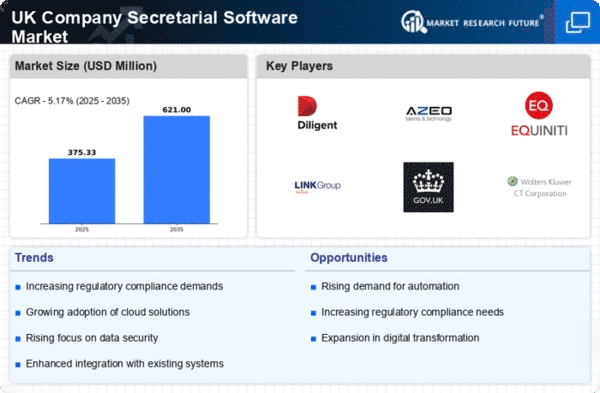

The company secretarial-software market is experiencing heightened demand due to increasing regulatory requirements in the UK. Companies are now required to maintain accurate records and ensure compliance with various laws, such as the Companies Act 2006. This has led to a surge in the adoption of software solutions that facilitate compliance management. According to recent data, approximately 70% of UK businesses have reported investing in software to streamline their compliance processes. The need for real-time updates and automated reporting is driving the growth of this market, as organizations seek to mitigate risks associated with non-compliance. As regulations continue to evolve, the company secretarial-software market is expected to expand further, providing tools that help businesses navigate complex legal landscapes.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in the UK are significantly influencing the company secretarial-software market. Organizations are increasingly adopting digital tools to enhance operational efficiency and reduce manual processes. This shift is evident as businesses aim to digitize their records and automate workflows, which can lead to cost savings and improved accuracy. Recent statistics indicate that around 60% of UK firms are prioritizing digital solutions to modernize their operations. The integration of company secretarial software into broader digital strategies is becoming essential, as firms recognize the importance of agility and responsiveness in a competitive environment. Consequently, the company secretarial-software market is poised for growth as more organizations embrace digital solutions.

Increased Demand for Data Security

As data breaches and cyber threats become more prevalent, the company secretarial-software market is witnessing a growing emphasis on data security. UK businesses are increasingly aware of the need to protect sensitive information, particularly in light of stringent data protection regulations such as the General Data Protection Regulation (GDPR). This has led to a surge in demand for software solutions that offer robust security features, including encryption and access controls. Recent surveys suggest that over 75% of companies in the UK consider data security a top priority when selecting software solutions. As organizations strive to safeguard their data, the company secretarial-software market is likely to evolve, incorporating advanced security measures to meet these demands.

Shift Towards Remote Work Solutions

The shift towards remote work arrangements in the UK has created new opportunities for the company secretarial-software market. With an increasing number of employees working from home, businesses require software that enables seamless collaboration and access to essential documents from various locations. This trend has prompted many organizations to invest in cloud-based company secretarial solutions that facilitate remote access and real-time updates. Data indicates that approximately 65% of UK companies are now utilizing cloud-based software to support their remote work strategies. As the remote work culture continues to solidify, the company secretarial-software market is expected to adapt, offering features that cater to the needs of a distributed workforce.

Growing Importance of Corporate Governance

The company secretarial-software market is being driven by the growing importance of corporate governance in the UK. Stakeholders are increasingly demanding transparency and accountability from organizations, prompting companies to adopt software solutions that enhance governance practices. This trend is reflected in the rising number of firms implementing governance frameworks and compliance tools. Recent data shows that around 80% of UK businesses recognize the need for effective governance mechanisms to build trust with stakeholders. As corporate governance becomes a focal point for organizations, the company secretarial-software market is likely to expand, providing tools that support best practices in governance and compliance.