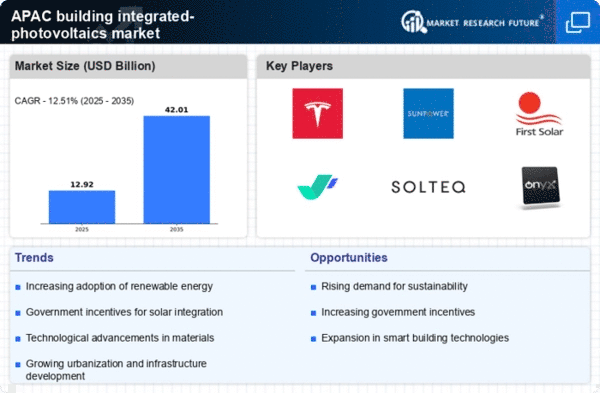

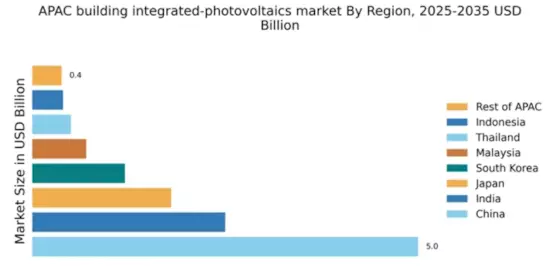

China : Unmatched Growth and Innovation

China holds a commanding 5.0% market share in the integrated photovoltaics sector, driven by robust government policies promoting renewable energy. The demand for BIPV solutions is surging, fueled by urbanization and a shift towards sustainable construction practices. Initiatives like the 14th Five-Year Plan emphasize green technology, while investments in infrastructure bolster industrial capabilities, creating a conducive environment for market expansion.

India : Emerging Market with High Potential

India's integrated photovoltaics market is valued at 2.5%, reflecting a significant growth trajectory. Key drivers include government initiatives like the Solar Mission, which aims to achieve 100 GW of solar capacity by 2022. The increasing demand for energy in urban areas and a focus on sustainable development are shaping consumption patterns, while infrastructure improvements support market growth.

Japan : Pioneering BIPV Applications

Japan's market share stands at 1.8%, characterized by advanced technology and innovation in integrated photovoltaics. The government promotes energy efficiency through policies like the Feed-in Tariff, encouraging residential and commercial adoption. Demand is driven by urban development and a cultural emphasis on sustainability, with a growing interest in aesthetic BIPV solutions.

South Korea : A Leader in Renewable Energy

South Korea captures 1.2% of the integrated photovoltaics market, bolstered by government incentives and a commitment to renewable energy. The Green New Deal aims to increase solar energy capacity significantly, driving demand for BIPV products. Urban centers like Seoul are key markets, with a focus on integrating solar technology into building designs.

Malaysia : Growing Demand for Sustainable Solutions

Malaysia's integrated photovoltaics market is valued at 0.7%, with growth driven by increasing energy needs and government support for renewable energy. The country's focus on sustainable development and urbanization is fostering demand for BIPV solutions. Key markets include Kuala Lumpur and Penang, where infrastructure development is paving the way for solar integration.

Thailand : A Growing Market for BIPV

Thailand holds a 0.5% market share in integrated photovoltaics, supported by government policies promoting renewable energy. The country's Power Development Plan emphasizes solar energy, driving demand for BIPV solutions. Urban areas like Bangkok are key markets, with a competitive landscape featuring both local and international players.

Indonesia : Emerging Market with Opportunities

Indonesia's integrated photovoltaics market is at 0.4%, with significant potential for growth. The government is increasingly focusing on renewable energy, aiming for 23% of the energy mix by 2025. Demand is rising in urban areas, with Jakarta being a key market. The competitive landscape is evolving, with both local and international companies entering the market.

Rest of APAC : Varied Markets with Unique Dynamics

The Rest of APAC accounts for a 0.38% market share in integrated photovoltaics, showcasing diverse opportunities. Each country presents unique regulatory environments and market conditions, influencing demand for BIPV solutions. Urbanization and sustainability trends are common drivers, with varying levels of government support across the region.