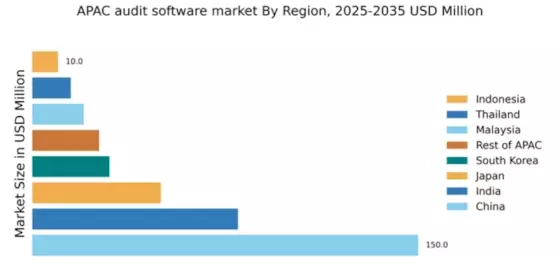

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 150.0, representing a significant portion of the APAC audit software market. Key growth drivers include rapid digital transformation, increasing regulatory compliance requirements, and a burgeoning SME sector. The government has implemented favorable policies to encourage technology adoption, while infrastructure improvements bolster industrial development, enhancing software accessibility and usage across various sectors.

India : Emerging Market with High Potential

Key markets include major cities like Bangalore, Mumbai, and Delhi, where tech adoption is high. The competitive landscape features players like Zoho and FreshBooks, alongside international giants like SAP and Oracle. The business environment is dynamic, with a focus on sectors such as finance, manufacturing, and IT services, driving the need for efficient audit solutions.

Japan : Cautious Growth and Innovation

Key markets include Tokyo and Osaka, where large corporations and SMEs coexist. The competitive landscape is dominated by local players like SAP Japan and international firms like Oracle. The business environment is marked by a preference for customized solutions, particularly in sectors such as manufacturing and finance, where compliance and accuracy are paramount.

South Korea : Tech-Driven Market Dynamics

Key markets include Seoul and Busan, where a vibrant startup ecosystem thrives. Major players like SAP and Oracle have a significant presence, competing with local firms. The business environment is characterized by rapid technological adoption, particularly in sectors such as finance and e-commerce, where efficient audit processes are critical.

Malaysia : Emerging Market with Opportunities

Key markets include Kuala Lumpur and Penang, where SMEs are increasingly adopting audit software. The competitive landscape features both local and international players, including SAP and Xero. The business environment is evolving, with a focus on sectors such as finance and manufacturing, where compliance and efficiency are becoming increasingly important.

Thailand : Compliance Drives Software Adoption

Key markets include Bangkok and Chiang Mai, where both large corporations and SMEs are adopting audit solutions. The competitive landscape includes local players and international firms like Oracle and Thomson Reuters. The business environment is dynamic, with a focus on sectors such as tourism and manufacturing, where compliance is critical.

Indonesia : Digital Transformation in Progress

Key markets include Jakarta and Surabaya, where the startup ecosystem is burgeoning. The competitive landscape features both local and international players, including Xero and FreshBooks. The business environment is evolving, with a focus on sectors such as e-commerce and finance, where efficient audit processes are becoming increasingly important.

Rest of APAC : Varied Demand Across Sub-Regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where local players and international firms compete. The competitive landscape is fragmented, with a mix of established companies and startups. The business environment varies significantly, with sectors such as agriculture, finance, and tourism driving demand for audit solutions.