Apac Antiscalant Size

APAC Antiscalant Market Growth Projections and Opportunities

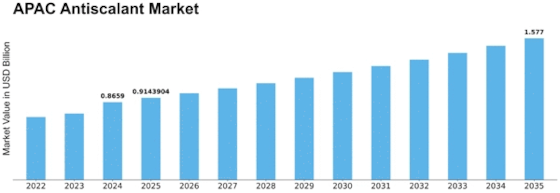

The Asia-Pacific (APAC) Antiscalant Market is prompted by different factors that together shape its dynamics and growth. One of the primary drivers of this market is the fast industrialization and urbanization across the region, leading to expanded water demand for commercial approaches. As industries amplify, the need for antiscalants to prevent scale formation and deposition in water-primarily based systems, which include boilers, cooling towers, and desalination vegetation, will become crucial. APAC Antiscalant Market Size will be worth USD 0.7 Billion in 2022. The antiscalant industry is projected to grow from USD 0.82 Billion in 2023 to USD 1.28 Billion by way of 2032, exhibiting a compound annual growth rate (CAGR) of 5.60% for the duration of the forecast period (2023 - 2032). Changing regulatory landscapes and water first-class requirements extensively affect the APAC Antiscalant Market. Governments inside the place are more and more specialized in water conservation, pleasant improvement, and environmental protection. Technological improvements in antiscalant formulations make contributions to market dynamics. Continuous research and development efforts lead to the introduction of superior antiscalant merchandise with improved performance, compatibility with various water assets, and better price effectiveness. Market elements are also stimulated with the aid of the expanding demand for water in numerous end-use sectors, which include energy era, chemical substances, and oil and gasoline. As industries strive to optimize water usage and decrease the environmental effects of water-associated methods, the position of antiscalants will become increasingly vital. Economic situations and business increases affect the APAC Antiscalant Market. As economies inside the place enjoy a boom, industries such as power technology, petrochemicals, and manufacturing witness extended interest. This increase translates right into higher demand for water treatment solutions, including antiscalants, to ensure the dependable and green operation of industrial processes. The aggressive panorama and industry collaborations play a tremendous role in shaping market dynamics. Antiscalant manufacturers and suppliers interact and collaborate with industries, water treatment service companies, and research institutions to enhance their product portfolios and deal with precise application wishes. Consumer recognition and training about water conservation and treatment practices contribute to market dynamics. The impact of world challenges, including climate change and water scarcity, additionally influences the APAC Antiscalant Market. Changing weather patterns and multiplied water stress in certain areas underscore the significance of effective water remedy practices. Antiscalants assist in mitigating the consequences of scaling in water-based structures, ensuring the supply of smooth and reliable water resources for industries dealing with weather-related challenges.

Leave a Comment