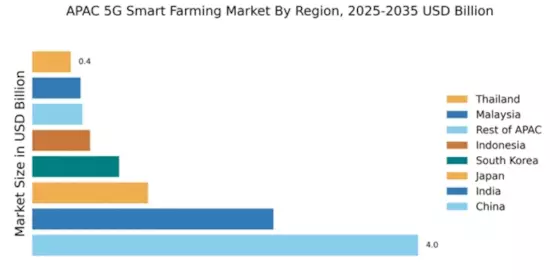

China : Innovative Agriculture Meets Technology

Key markets include provinces like Shandong and Henan, where agricultural output is significant. The competitive landscape features major players like Deere & Company and Trimble Inc., who are investing heavily in local partnerships. The business environment is characterized by a strong focus on innovation, with local startups emerging in the agri-tech space. Applications in precision irrigation and crop monitoring are gaining traction, further enhancing productivity.

India : Agricultural Transformation Through Technology

Key markets include Punjab, Haryana, and Maharashtra, where agricultural output is substantial. The competitive landscape features players like AG Leader Technology and BASF SE, who are establishing a foothold in the region. The business environment is evolving, with increasing investments in agri-tech startups. Applications in soil health monitoring and yield prediction are becoming more prevalent, driving efficiency in farming practices.

Japan : Technological Advancements in Farming

Key markets include Hokkaido and Kumamoto, where advanced farming techniques are being adopted. The competitive landscape features major players like Topcon Positioning Systems and Trimble Inc., who are actively collaborating with local farmers. The business environment is conducive to innovation, with a focus on robotics and IoT applications in agriculture. Technologies for crop monitoring and automated machinery are gaining traction, enhancing productivity.

South Korea : Innovative Solutions for Agriculture

Key markets include Jeollanam-do and Gyeonggi-do, where innovative farming practices are being adopted. The competitive landscape features players like Raven Industries and Yara International ASA, who are investing in local partnerships. The business environment is characterized by a strong focus on R&D, with applications in precision irrigation and crop health monitoring becoming increasingly popular.

Malaysia : Sustainable Farming Through Technology

Key markets include Selangor and Penang, where agricultural output is significant. The competitive landscape features players like CNH Industrial N.V. and BASF SE, who are establishing a presence in the region. The business environment is evolving, with increasing investments in agri-tech startups. Applications in precision farming and crop monitoring are becoming more prevalent, enhancing productivity and sustainability.

Thailand : Innovative Solutions for Agriculture

Key markets include Chiang Mai and Nakhon Ratchasima, where innovative farming practices are being adopted. The competitive landscape features players like Trimble Inc. and Yara International ASA, who are actively collaborating with local farmers. The business environment is conducive to innovation, with a focus on IoT applications in agriculture. Technologies for crop monitoring and automated machinery are gaining traction, enhancing productivity.

Indonesia : Transforming Agriculture with Technology

Key markets include West Java and Central Java, where agricultural output is significant. The competitive landscape features players like Deere & Company and AG Leader Technology, who are establishing a foothold in the region. The business environment is evolving, with increasing investments in agri-tech startups. Applications in soil health monitoring and yield prediction are becoming more prevalent, driving efficiency in farming practices.

Rest of APAC : Regional Variations in Agriculture

Key markets include Vietnam and the Philippines, where agricultural output is significant. The competitive landscape features a mix of local and international players, including BASF SE and CNH Industrial N.V. The business environment is evolving, with increasing investments in agri-tech startups. Applications in precision farming and crop monitoring are becoming more prevalent, enhancing productivity and sustainability.