Rising Demand for Food Security

The increasing global population and the corresponding demand for food security are driving the The increasing global population and the corresponding demand for food security are driving smart farming.. As the UK faces challenges related to food production, the need for efficient agricultural practices becomes paramount. The 5g smart-farming market offers solutions that enhance crop yields and resource management, addressing the urgent need for sustainable food production. Reports indicate that by 2030, food production must increase by 50% to meet global demands. This urgency compels farmers to adopt smart farming technologies that leverage 5G connectivity for better decision-making and resource allocation. Consequently, the 5g smart-farming market is likely to see substantial growth as it aligns with the overarching goal of ensuring food security.

Increased Focus on Sustainability

Sustainability is becoming a central theme in agriculture, influencing the Sustainability is becoming a central theme in agriculture.. Farmers are increasingly aware of the environmental impact of traditional farming practices and are seeking ways to reduce their carbon footprint. The integration of 5G technology facilitates precision agriculture, which optimizes resource use and minimizes waste. For example, smart irrigation systems powered by 5G can significantly reduce water usage by up to 40%, while also improving crop health. This focus on sustainable practices not only meets consumer demand for environmentally friendly products but also aligns with government regulations aimed at reducing agricultural emissions. Thus, the 5g smart-farming market is poised for growth as sustainability becomes a priority for farmers.

Market Competition and Innovation

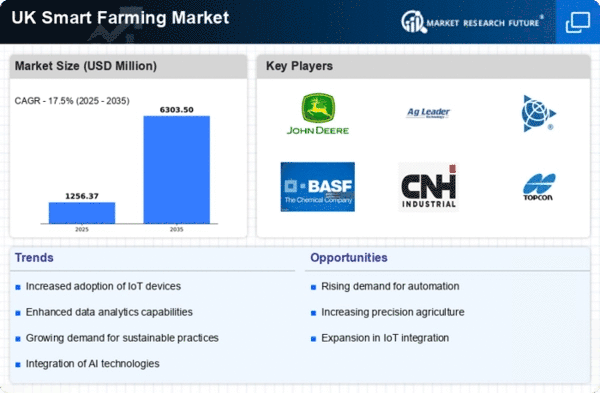

The competitive landscape of the The competitive landscape of smart farming is fostering innovation. is fostering innovation and driving advancements in agricultural technology. As various companies enter the market, there is a notable increase in research and development efforts aimed at creating cutting-edge solutions for farmers. This competition encourages the development of new applications and services that leverage 5G connectivity, such as advanced analytics platforms and automated farming equipment. The market is projected to grow at a CAGR of 25% over the next five years, reflecting the increasing interest from both established players and startups. This dynamic environment not only enhances the offerings available to farmers but also propels the overall growth of the 5g smart-farming market.

Government Initiatives and Support

Government initiatives play a crucial role in the growth of the Government initiatives play a crucial role in the growth of smart farming.. The UK government has been actively promoting the adoption of advanced technologies in agriculture through various funding programs and incentives. For instance, the Agriculture Bill aims to support farmers in transitioning to sustainable practices, which includes the integration of 5G technology. Additionally, the UK government has allocated £100 million to enhance rural connectivity, which is essential for the deployment of 5G networks in farming areas. Such initiatives not only encourage farmers to adopt smart technologies but also create a conducive environment for the growth of the 5g smart-farming market, potentially leading to increased agricultural productivity and sustainability.

Technological Advancements in Agriculture

The The market is experiencing a surge due to rapid technological advancements. is experiencing a surge due to rapid technological advancements in agricultural practices. Innovations such as IoT devices, drones, and automated machinery are becoming increasingly integrated with 5G networks, enabling real-time data collection and analysis. This integration allows farmers to monitor crop health, soil conditions, and weather patterns with unprecedented accuracy. According to recent data, the adoption of smart farming technologies is projected to increase by 30% in the next five years, driven by the need for efficiency and productivity. As farmers seek to optimize yields and reduce costs, the 5g smart-farming market is likely to expand significantly, fostering a new era of agricultural productivity in the UK.