Rising Urbanization

The increasing trend of urbanization appears to be a significant driver for the Anticoagulant Rodenticides Market. As more people migrate to urban areas, the demand for effective pest control solutions escalates. Urban environments, characterized by dense populations and limited space, create ideal conditions for rodent infestations. Consequently, municipalities and property managers are likely to invest in anticoagulant rodenticides to mitigate health risks associated with rodent-borne diseases. Reports indicate that the rodent control market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, underscoring the urgency for effective rodent management solutions. This trend suggests that the Anticoagulant Rodenticides Market will continue to expand as urbanization progresses.

Agricultural Expansion

The expansion of agricultural activities is another critical driver for the Anticoagulant Rodenticides Market. As agricultural production increases to meet the demands of a growing population, the risk of rodent infestations in crops also rises. Farmers are increasingly adopting anticoagulant rodenticides to protect their yields from rodent damage, which can lead to significant economic losses. The agricultural sector is projected to grow at a rate of 3.2% annually, indicating a sustained need for effective pest management solutions. This trend suggests that the Anticoagulant Rodenticides Market will benefit from the agricultural sector's growth, as farmers seek reliable methods to safeguard their crops.

Increased Awareness of Health Risks

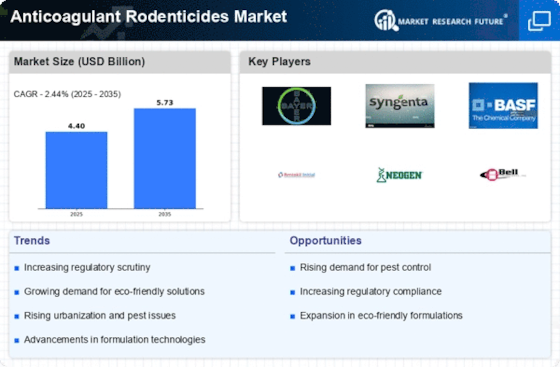

Growing awareness regarding the health risks posed by rodents is driving the Anticoagulant Rodenticides Market. Rodents are known carriers of various diseases, including hantavirus and leptospirosis, which can have severe health implications for humans. As public health campaigns emphasize the importance of pest control, consumers and businesses are more inclined to utilize anticoagulant rodenticides as a preventive measure. The market for rodenticides is expected to reach USD 4 billion by 2026, reflecting the heightened focus on health and safety. This awareness not only influences consumer behavior but also encourages regulatory bodies to enforce stricter pest control measures, further propelling the demand for anticoagulant rodenticides.

Regulatory Support for Pest Management

Regulatory frameworks supporting pest management practices are emerging as a vital driver for the Anticoagulant Rodenticides Market. Governments are increasingly recognizing the importance of effective rodent control in safeguarding public health and agricultural productivity. This recognition has led to the establishment of guidelines and standards that promote the responsible use of anticoagulant rodenticides. Such regulations not only ensure consumer safety but also encourage manufacturers to innovate and improve their products. The anticipated growth in the pest control market, projected to reach USD 20 billion by 2027, indicates that regulatory support will play a crucial role in shaping the future of the Anticoagulant Rodenticides Market.

Technological Innovations in Pest Control

Technological advancements in pest control methods are likely to influence the Anticoagulant Rodenticides Market positively. Innovations such as the development of more effective formulations and delivery systems for anticoagulant rodenticides enhance their efficacy and safety. These advancements not only improve the effectiveness of rodent control but also address environmental concerns associated with traditional rodenticides. The introduction of biodegradable and less toxic alternatives is expected to attract environmentally conscious consumers, thereby expanding the market. As technology continues to evolve, the Anticoagulant Rodenticides Market may witness a shift towards more sustainable and efficient pest control solutions.