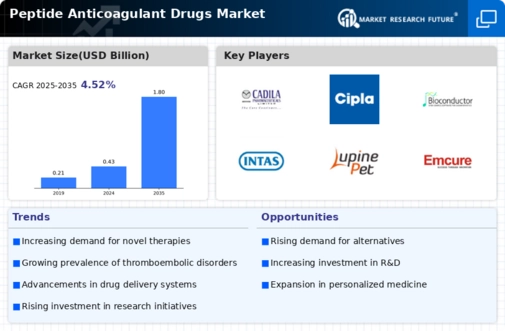

Market Growth Projections

The Global Peptide Anticoagulant Drugs Market Industry is on a growth trajectory, with projections indicating a market value of 1.8 USD Billion by 2035. This growth is underpinned by various factors, including advancements in drug development, increasing prevalence of thromboembolic disorders, and a shift towards personalized medicine. The anticipated compound annual growth rate of 13.92% from 2025 to 2035 suggests a robust expansion of the market, driven by innovations and evolving healthcare needs. This upward trend reflects the industry's potential to address the challenges posed by thromboembolic conditions and improve patient outcomes.

Growing Awareness and Education

The Global Peptide Anticoagulant Drugs Market Industry is benefiting from increased awareness and education regarding thromboembolic disorders and their treatment options. Healthcare professionals and patients are becoming more informed about the risks associated with these conditions and the potential benefits of peptide anticoagulants. Educational initiatives and campaigns are playing a crucial role in disseminating information, which is likely to drive demand for these therapies. As awareness continues to grow, the market is expected to expand, with a projected value of 0.43 USD Billion in 2024, indicating the importance of education in shaping treatment choices in the Global Peptide Anticoagulant Drugs Market Industry.

Advancements in Drug Development

Innovations in drug development are propelling the Global Peptide Anticoagulant Drugs Market Industry forward. Recent advancements in biotechnology and molecular biology have facilitated the design of novel peptide-based anticoagulants that offer improved efficacy and safety profiles. These developments are likely to enhance patient compliance and treatment outcomes, thereby expanding market opportunities. As a result, the market is projected to grow significantly, with an estimated value of 1.8 USD Billion by 2035. This growth reflects the industry's commitment to harnessing scientific advancements to address the evolving needs of patients with thromboembolic disorders.

Regulatory Support and Approvals

Regulatory bodies are increasingly supporting the development and approval of peptide anticoagulants, which is a key driver for the Global Peptide Anticoagulant Drugs Market Industry. Streamlined approval processes and favorable regulations are encouraging pharmaceutical companies to invest in research and development of these innovative drugs. This regulatory environment not only accelerates the introduction of new therapies but also enhances market confidence among stakeholders. As a result, the market is poised for substantial growth, with projections indicating a value of 1.8 USD Billion by 2035, reflecting the positive impact of regulatory support on the industry's trajectory.

Increasing Demand for Personalized Medicine

The shift towards personalized medicine is influencing the Global Peptide Anticoagulant Drugs Market Industry. Healthcare providers are increasingly recognizing the importance of tailoring treatments to individual patient profiles, which enhances therapeutic efficacy and minimizes adverse effects. Peptide anticoagulants, with their ability to be customized based on patient-specific factors, are well-positioned to meet this demand. This trend is expected to drive market growth, as the industry adapts to the evolving landscape of personalized healthcare. The anticipated compound annual growth rate of 13.92% from 2025 to 2035 underscores the potential for peptide anticoagulants to play a pivotal role in personalized treatment strategies.

Rising Prevalence of Thromboembolic Disorders

The Global Peptide Anticoagulant Drugs Market Industry is experiencing growth due to the increasing prevalence of thromboembolic disorders, such as deep vein thrombosis and pulmonary embolism. These conditions are becoming more common, driven by factors like an aging population and sedentary lifestyles. As healthcare providers seek effective treatment options, peptide anticoagulants are gaining traction due to their targeted action and reduced side effects. This trend is expected to contribute significantly to the market, with projections indicating a market value of 0.43 USD Billion in 2024, highlighting the urgent need for innovative therapeutic solutions in the Global Peptide Anticoagulant Drugs Market Industry.