Research Methodology on Anti Slip Coatings Market

Introduction

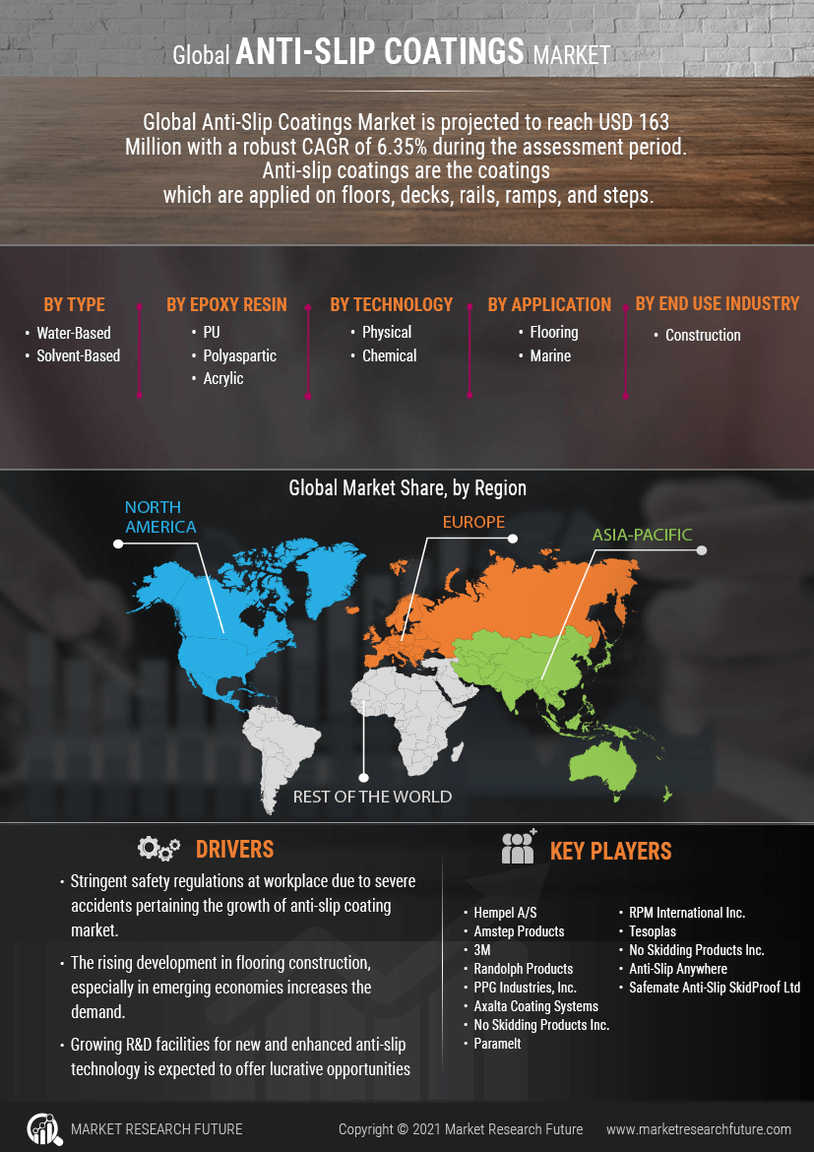

The global anti-slip coatings market is estimated to expand at a steady CAGR during the forecast period from 2023 to 2030. On the back of strong demand from the construction industry, the anti-slip coatings market is projected to observe steady growth during the review period. On account of the increasing demand for non-slip floors in public places, the anti-slip coatings market is likely to boost growth in the near future.

The focus of this research is to understand the key trends and dynamics affecting the global Anti-Slip Coatings Market and by that to assess its growth prospects and market potential over the forecast period. By using secondary research and primary research, this report will provide a comprehensive overview of the Anti-Slip Coatings Market.

Research Methodology

This research methodology is based on the primary and secondary research methods which is intended to provide an accurate and holistic view of the global anti-slip coatings market. In order to collect data relevant to this market, this study has identified a range of sources. These sources of data include official websites, company websites, books, government publications, statistical databases, magazines, industry reports, white papers, dissertations, books, and other relevant sources.

Data Collection

For the purpose of this market research report, a variety of data collection techniques, such as secondary and primary research, were used. The secondary resources used to collect data include the official websites of related associations, various governmental agencies, and statistical databases composed of legal documents, news notices, and other related publications. The primary sources used to collect data include interviews with industry experts, such as sector experts, supply chain experts, and technical writers. The survey and interview data were collected and analyzed to understand, comprehend, and compare market scenarios and develop a comprehensive overview of the market research.

Data Analysis

The collected data was analyzed by using a variety of methods, including descriptive and inferential statistics, descriptive techniques, demand structure analysis, demand structural analysis, and others. The primary and secondary data sources were combined to identify and decipher the market's key parameters and trends. The collected data was used to derive different definitions of qualitative and quantitative analysis. We created detailed models for the market based on these parameters.

After obtaining the required data and information from primary and secondary sources, the quality of the data was validated to ensure accuracy and credibility. The data and analysis were then modified according to the actual project requirements and used to develop a comprehensive market report.

Competitive Analysis

The competitive landscape was analyzed by considering the leading players in the Global Anti-Slip Coatings Market. The market's share was compared to that of the market shares of key players to provide an accurate picture of the market's structure. The key players analyzed included 3M, PPG Industries, Sherwin-Williams, BASF SE, RPM International, The Valspar Corporation, Covestro AG, and others. The strategic initiatives, new product developments, etc. of leading players were identified and used to structure the market report.

Conclusion

All the data gathered, synthesized, analyzed, and interpreted in this study was used to assess the market and develop a credible market report. The collected secondary data was verified, validated, and validated by collecting primary data. The results of this study reflect the verified and validated secondary data. The research methodology adopted for this report was to gather and analyze data from primary and secondary sources and provide factual and reliable information which can help stakeholders in the Global Anti-Slip Coatings Market, understand competitive dynamics, and make informed business decisions.