Shift Towards Clean Beauty

The shift towards clean beauty is emerging as a significant driver in the anti-acne cosmetic Market. Consumers are increasingly seeking products that are free from harmful chemicals and synthetic ingredients, opting instead for formulations that prioritize safety and sustainability. This trend is particularly pronounced among younger demographics, who are more likely to scrutinize ingredient lists and demand transparency from brands. Market Research Future indicates that the clean beauty segment is expected to witness substantial growth, with consumers willing to pay a premium for products that align with their values. Consequently, brands that embrace clean beauty principles and offer anti-acne solutions that are both effective and environmentally friendly are likely to thrive in the Anti-Acne Cosmetic Market. This shift not only reflects changing consumer preferences but also encourages brands to innovate responsibly.

Increasing Awareness of Skin Health

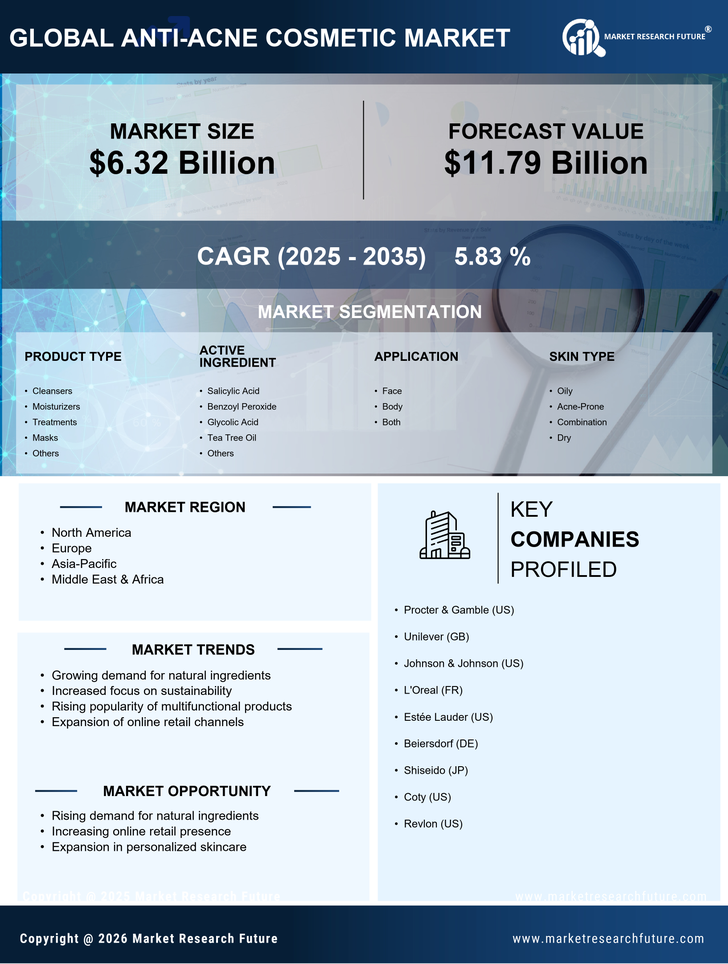

The rising awareness regarding skin health is a pivotal driver for the Anti-Acne Cosmetic Market. Consumers are becoming increasingly educated about the importance of skincare, particularly in relation to acne management. This heightened awareness is reflected in the growing demand for products that not only treat acne but also promote overall skin health. According to recent data, the skincare segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This trend indicates that consumers are willing to invest in effective anti-acne solutions, thereby propelling the Anti-Acne Cosmetic Market forward. Furthermore, social media platforms play a crucial role in disseminating information about skincare, leading to a more informed consumer base that actively seeks out products that align with their skin health goals.

Rising Incidence of Acne Among Adults

The rising incidence of acne among adults is a critical factor driving the Anti-Acne Cosmetic Market. Traditionally perceived as a teenage concern, acne is increasingly affecting adults due to various factors such as stress, hormonal changes, and lifestyle choices. Recent studies indicate that nearly 50% of adults experience acne at some point in their lives, leading to a surge in demand for effective anti-acne products tailored for adult skin. This demographic shift is prompting brands to develop specialized formulations that address the unique needs of adult acne sufferers. As a result, the Anti-Acne Cosmetic Market is witnessing a diversification of product offerings, catering to a broader audience. This trend not only expands the market potential but also encourages brands to engage with consumers through targeted marketing strategies.

Influence of Social Media and Influencers

The influence of social media and beauty influencers is a powerful driver in the Anti-Acne Cosmetic Market. Platforms such as Instagram and TikTok have transformed the way consumers discover and engage with skincare products. Influencers play a pivotal role in shaping consumer perceptions and preferences, often showcasing their personal experiences with anti-acne products. This trend has led to a surge in product recommendations and reviews, significantly impacting purchasing decisions. Market data suggests that products endorsed by influencers tend to experience higher sales, as consumers increasingly trust peer recommendations over traditional advertising. Consequently, brands that effectively leverage social media marketing and collaborate with influencers are likely to enhance their visibility and credibility within the Anti-Acne Cosmetic Market. This dynamic not only drives sales but also fosters a sense of community among consumers seeking effective acne solutions.

Technological Advancements in Formulations

Technological advancements in cosmetic formulations are significantly influencing the Anti-Acne Cosmetic Market. Innovations in ingredient technology, such as the development of encapsulated actives and enhanced delivery systems, are enabling more effective treatment options for acne. These advancements allow for targeted action on acne-causing bacteria and inflammation, which is crucial for consumers seeking rapid results. Market data suggests that the demand for high-efficacy products is on the rise, with consumers increasingly favoring formulations that incorporate cutting-edge technology. As a result, brands that invest in research and development to create innovative anti-acne solutions are likely to gain a competitive edge in the Anti-Acne Cosmetic Market. This trend not only enhances product efficacy but also fosters consumer trust in the brands that prioritize scientific advancements.