Diverse Applications Across Industries

The Anodic Aluminum Oxide Wafer Market benefits from its diverse applications across multiple sectors, including electronics, aerospace, and biomedical fields. The unique properties of anodic aluminum oxide, such as high thermal stability and excellent electrical insulation, make it suitable for a wide range of uses. For instance, in the electronics sector, these wafers are utilized in the production of semiconductors and microchips, which are essential for modern technology. The aerospace industry also employs anodic aluminum oxide for lightweight and corrosion-resistant components. As industries continue to innovate and expand, the demand for anodic aluminum oxide wafers is expected to rise, with market analysts projecting a growth trajectory that reflects the increasing integration of these materials in advanced applications.

Rising Demand for Lightweight Materials

The Anodic Aluminum Oxide Wafer Market is witnessing a rising demand for lightweight materials, particularly in the automotive and aerospace sectors. As manufacturers strive to enhance fuel efficiency and reduce emissions, the need for lightweight yet durable materials has become paramount. Anodic aluminum oxide wafers offer an ideal solution, combining low weight with high strength and resistance to wear. This trend is likely to drive significant growth in the market, as companies increasingly prioritize materials that contribute to overall performance and sustainability. Furthermore, the automotive industry is projected to adopt anodic aluminum oxide wafers in various components, potentially leading to a market expansion that aligns with global trends towards lightweighting and energy efficiency.

Technological Advancements in Manufacturing

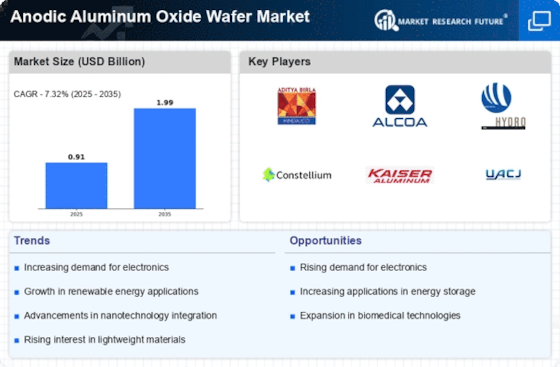

The Anodic Aluminum Oxide Wafer Market is experiencing a surge in technological advancements that enhance production efficiency and product quality. Innovations in anodization techniques, such as hard anodizing and micro-arc oxidation, are being adopted to create wafers with superior properties. These advancements not only improve the durability and corrosion resistance of the wafers but also expand their applicability in various sectors, including electronics and optics. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by the increasing demand for high-performance materials. Furthermore, automation in manufacturing processes is likely to reduce production costs, making anodic aluminum oxide wafers more accessible to a broader range of industries.

Sustainability and Environmental Regulations

The Anodic Aluminum Oxide Wafer Market is increasingly influenced by sustainability initiatives and stringent environmental regulations. Manufacturers are under pressure to adopt eco-friendly practices, leading to the development of anodization processes that minimize waste and energy consumption. The shift towards sustainable materials is evident, as industries seek to reduce their carbon footprint. This trend is further supported by government policies promoting the use of recyclable materials, which enhances the appeal of anodic aluminum oxide wafers. As a result, the market is likely to witness a steady increase in demand, particularly from sectors focused on sustainability, such as automotive and renewable energy. The integration of sustainable practices not only aligns with regulatory requirements but also enhances brand reputation, potentially driving market growth.

Increased Investment in Research and Development

The Anodic Aluminum Oxide Wafer Market is experiencing increased investment in research and development (R&D) as companies seek to innovate and improve product offerings. This focus on R&D is crucial for developing new applications and enhancing the performance characteristics of anodic aluminum oxide wafers. Companies are exploring novel anodization techniques and composite materials that could lead to breakthroughs in functionality and efficiency. The investment in R&D is expected to yield advancements that not only meet current market demands but also anticipate future trends. As a result, the market may see a proliferation of new products and applications, further solidifying the position of anodic aluminum oxide wafers in various industries.