Rising Energy Costs

The escalating costs of energy are compelling industries to seek more efficient cooling solutions, thereby driving the Annular Cooler Market. As energy prices continue to rise, businesses are under pressure to reduce operational expenses. Annular coolers, known for their energy efficiency, present a viable solution to this challenge. Reports indicate that companies can achieve energy savings of up to 25% by switching to annular cooling systems. This financial benefit is likely to encourage more organizations to invest in these technologies, further propelling the growth of the Annular Cooler Market. The focus on cost-effective cooling solutions is expected to remain a key driver as industries navigate the complexities of rising energy costs.

Focus on Sustainability

The increasing emphasis on sustainability and environmental responsibility is significantly influencing the Annular Cooler Market. Companies are increasingly adopting eco-friendly practices, which include the implementation of energy-efficient cooling systems. The shift towards sustainable operations is not merely a trend but a necessity, as regulatory bodies impose stricter environmental standards. Data suggests that organizations that invest in sustainable technologies can reduce their operational costs by up to 30%. This financial incentive, coupled with the growing consumer preference for environmentally responsible products, is likely to drive the demand for annular coolers. As a result, the Annular Cooler Market may witness a surge in adoption rates as businesses strive to align with sustainability goals while ensuring efficient cooling solutions.

Technological Innovations

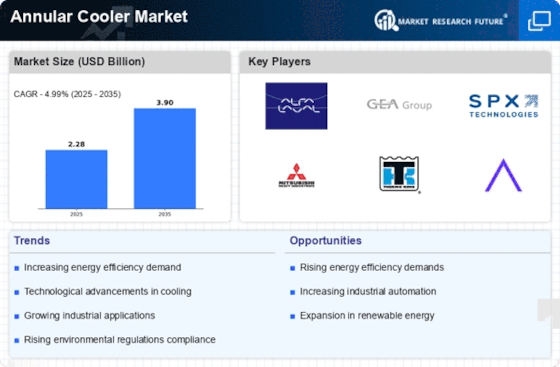

Technological advancements are playing a pivotal role in shaping the Annular Cooler Market. Innovations in materials and design are enhancing the performance and efficiency of annular coolers. For instance, the integration of smart technologies allows for real-time monitoring and optimization of cooling processes. This not only improves energy efficiency but also extends the lifespan of cooling systems. Market data indicates that the adoption of advanced cooling technologies is expected to grow by approximately 6% annually. As industries increasingly seek to leverage these innovations, the Annular Cooler Market is likely to experience a robust growth trajectory, driven by the demand for cutting-edge cooling solutions that meet modern operational challenges.

Global Supply Chain Dynamics

The evolving dynamics of The Annular Cooler Industry in various ways. As companies adapt to changing market conditions, the need for efficient cooling systems becomes paramount. Supply chain disruptions have highlighted the importance of reliable cooling solutions in maintaining product quality and operational efficiency. Data suggests that industries are increasingly investing in robust cooling technologies to mitigate risks associated with supply chain vulnerabilities. This trend is likely to drive the demand for annular coolers, as businesses seek to enhance their resilience and ensure consistent performance. Consequently, the Annular Cooler Market may experience growth as organizations prioritize the integration of effective cooling systems within their supply chain strategies.

Increasing Industrialization

The ongoing trend of industrialization across various sectors appears to be a primary driver for the Annular Cooler Market. As industries expand, the demand for efficient cooling systems rises, particularly in sectors such as manufacturing and power generation. The need for reliable cooling solutions to maintain optimal operational temperatures is critical. According to recent data, the industrial sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to stimulate investments in advanced cooling technologies, including annular coolers, which are known for their efficiency and effectiveness. Consequently, the Annular Cooler Market is expected to benefit from this industrial expansion, as companies seek to enhance productivity while minimizing energy consumption.