Animal Model Size

Market Size Snapshot

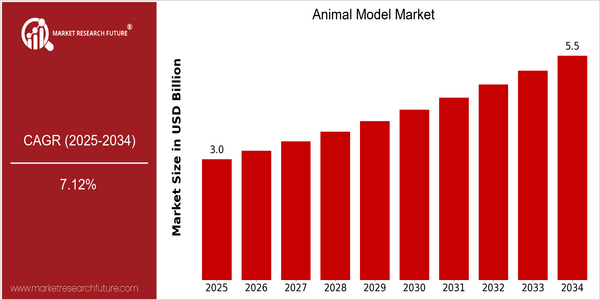

| Year | Value |

|---|---|

| 2025 | USD 2.98 Billion |

| 2034 | USD 5.53 Billion |

| CAGR (2025-2034) | 7.12 % |

Note – Market size depicts the revenue generated over the financial year

Animal models have been used in the study of medicine for a long time, and their use has been growing at an alarming rate. In the year 2025 the animal models market is expected to reach $2.98 billion, and by 2034 it is expected to reach $5.53 billion. This is a CAGR of 7.12% for the forecast period. The increasing occurrence of chronic diseases and the increasing demand for personalized medicine is driving the demand for improved animal models in research and development. Moreover, advancements in genetic engineering and the growing emphasis on ethical research practices are expected to drive the growth of the market. The major players in the animal models market, such as Charles River Laboratories, The Jackson Laboratory, and Envigo, are taking strategic initiatives to strengthen their market presence. These companies are collaborating with other companies to develop new and improved animal models to meet the growing research and development needs. Recent product launches, for example, have focused on genetically modified organisms (GMOs) and improved breeding techniques. Moreover, as the biomedical research landscape continues to evolve, the animal models market will play a crucial role in facilitating the discovery and development of new drugs.

Regional Market Size

Regional Deep Dive

'The animal model market is characterized by a high growth potential in various regions, owing to the increasing demand for individualized medicine and the increasing demand for ethical research. The animal model market is characterized by its own regional market dynamics, influenced by the regulatory framework, research funding and the cultural attitude towards animal research. North America is particularly strong because of its strong pharmaceutical and biotechnology industries, while Europe is characterized by strict regulations and a focus on alternative models. Asia-Pacific is growing rapidly, driven by increasing investment in research and development, while the Middle East and Africa face challenges related to the regulatory framework and the lack of development in the research environment. Latin America is emerging as a major player, with increasing research activities and international collaboration.

Europe

- The European Union's REACH regulation is pushing for the development of alternative testing methods, which is driving innovation in the animal model market as companies seek to comply with these stringent regulations.

- Organizations like the European Society for Animal Models in Research and Education (EAMRE) are promoting best practices and ethical standards in animal research, influencing market dynamics towards more humane approaches.

Asia Pacific

- China is rapidly becoming a leader in the animal model market, with significant investments in biotechnology and pharmaceutical research, leading to an increase in the availability of genetically modified animal models.

- The establishment of the National Center for Drug Screening in Shanghai is fostering collaboration between academia and industry, enhancing the development of animal models for drug discovery.

Latin America

- Brazil is witnessing a surge in research initiatives related to animal models, supported by government funding and partnerships with international research organizations.

- The Latin American Society of Laboratory Animal Science (LASLAC) is working to improve training and standards in animal research, which is expected to enhance the quality and reliability of animal models in the region.

North America

- The U.S. National Institutes of Health (NIH) has increased funding for animal research, particularly in areas like cancer and neurological disorders, which is expected to enhance the development of innovative animal models.

- Recent regulatory changes, such as the FDA's guidance on the use of animal models in drug development, are streamlining the approval process and encouraging more companies to invest in animal model research.

Middle East And Africa

- The establishment of the African Society for Laboratory Animal Science (ASLAS) is promoting the ethical use of animals in research, which is expected to improve standards and practices in the region.

- Government initiatives in countries like South Africa are focusing on enhancing research capabilities and infrastructure, which could lead to increased investment in animal model studies.

Did You Know?

“Approximately 95% of all drugs that enter clinical trials fail, often due to inadequate animal models that do not accurately predict human responses.” — FDA and various pharmaceutical industry reports

Segmental Market Size

The Animal Model Market is a critical component of the preclinical research landscape, and is currently experiencing steady growth, fueled by the increasing demand for novel therapies and individualized medicine. The rising prevalence of chronic diseases, which require extensive research and development, and the stringent regulatory framework, which mandates the use of animal models for safety and efficacy testing, are key drivers for this market. The recent developments in genetic engineering and biotechnology have further increased the significance of animal models in research, further bolstering the market. The Animal Model Market is currently at a mature stage, with market leaders Charles River Laboratories and Envigo Research leading the charge. These companies are implementing animal models across various applications, such as drug discovery, toxicology testing and disease modeling. Among the key trends escalating the growth of this market are the rising focus on humane research practices, the integration of novel technologies, such as CRISPR and advanced imaging, which are reshaping the way animal models are used in research. The emphasis on reducing the use of animals in research is also spurring the development of alternative models, which will further ensure that this market remains agile and responsive to industry needs.

Future Outlook

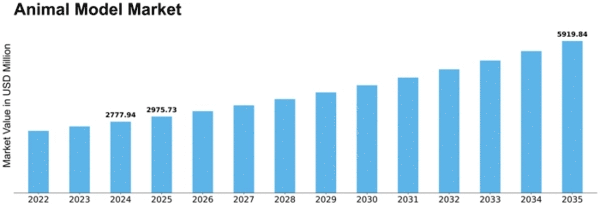

The Animal Models Market is expected to grow at a CAGR of 7.12% from 2025 to 2035. This growth is driven by the increasing demand for the development of new drugs and the introduction of a personal approach to medicine, as well as the increasing prevalence of chronic diseases that require the use of new research methods. Also, as the pharmaceutical and biotechnology industries continue to increase their R & D budgets, the use of animal models in preclinical testing is expected to increase, resulting in a higher penetration of the market in both developed and emerging countries. Furthermore, the integration of genetic engineering and CRISPR technology is expected to increase the efficiency and relevance of animal models in research. In addition, the regulatory framework for the ethical use of animal models is expected to be more conducive to market growth. Besides, the shift towards more humane and alternative testing methods will also shape the market and drive companies to develop new products. All in all, the Animal Models Market is expected to experience a dynamic transformation, driven by scientific advances and regulatory support, making it a critical part of the biomedical research system.

Leave a Comment