Regulatory Frameworks

The establishment of regulatory frameworks supporting animal welfare is a key driver for the Animal Microchip Implant Market. Governments and animal welfare organizations are increasingly advocating for the mandatory microchipping of pets, particularly in urban areas. This regulatory push aims to reduce the number of lost pets and improve their chances of being reunited with their owners. Recent legislation in various regions has made microchipping a requirement for pet registration, which has led to a notable increase in microchip adoption rates. As these regulations become more widespread, the Animal Microchip Implant Market is poised for growth, as compliance becomes essential for pet owners.

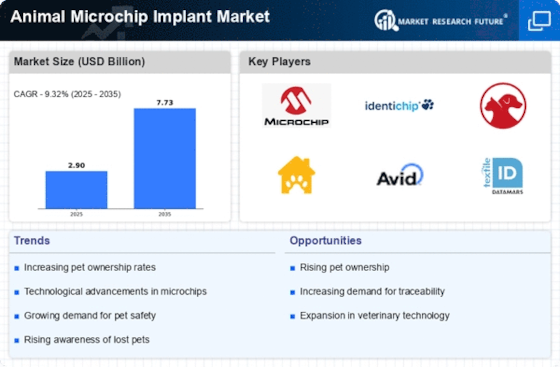

Increasing Pet Ownership

The rise in pet ownership is a notable driver for the Animal Microchip Implant Market. As more households adopt pets, the need for effective identification and tracking solutions becomes paramount. In recent years, statistics indicate that pet ownership rates have surged, with millions of new pets being welcomed into homes annually. This trend not only enhances the emotional bond between humans and animals but also raises concerns about pet safety and recovery in case of loss. Microchipping pets provides a reliable method for identification, thereby addressing these concerns. The Animal Microchip Implant Market is likely to benefit from this growing trend, as more pet owners seek to ensure the safety and traceability of their beloved companions.

Technological Innovations

Technological advancements play a crucial role in shaping the Animal Microchip Implant Market. Innovations in microchip technology have led to the development of smaller, more efficient, and cost-effective implants. These advancements enhance the functionality of microchips, allowing for features such as GPS tracking and health monitoring. As technology continues to evolve, the demand for advanced microchip solutions is expected to rise. Market data suggests that the integration of these technologies could lead to a significant increase in adoption rates among pet owners. Furthermore, the Animal Microchip Implant Market is likely to see a shift towards more sophisticated products that cater to the evolving needs of consumers, thereby driving growth.

Enhanced Pet Recovery Solutions

The need for effective pet recovery solutions is a driving force in the Animal Microchip Implant Market. With the increasing number of lost pets each year, the demand for reliable identification methods has never been more critical. Microchips provide a permanent solution for pet identification, significantly improving the chances of reuniting lost pets with their owners. Recent studies indicate that microchipped pets are more likely to be returned home than those without identification. This growing recognition of the importance of microchips in recovery efforts is likely to propel the Animal Microchip Implant Market forward, as more pet owners seek to invest in this essential technology.

Consumer Awareness and Education

Consumer awareness regarding the benefits of microchipping pets is a significant driver for the Animal Microchip Implant Market. Educational campaigns by veterinarians and animal welfare organizations have increased public knowledge about the importance of microchips in ensuring pet safety. As pet owners become more informed about the risks of losing their pets and the advantages of microchipping, the demand for these implants is likely to rise. Market data indicates that regions with higher levels of consumer education show increased microchip adoption rates. This trend suggests that as awareness continues to grow, the Animal Microchip Implant Market will experience a corresponding increase in demand.