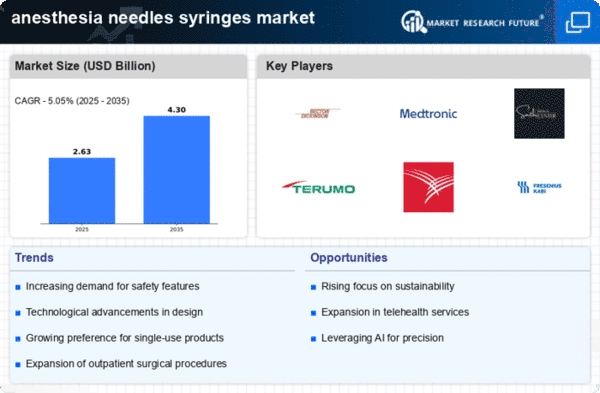

The anesthesia needles syringes Market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and regional expansion. Key players such as Becton Dickinson and Company (US), Medtronic plc (IE), and Terumo Corporation (JP) are actively pursuing strategies that enhance their market positioning. Becton Dickinson and Company (US) focuses on technological advancements in needle design, aiming to improve patient safety and comfort. Meanwhile, Medtronic plc (IE) emphasizes digital transformation, integrating smart technologies into their product offerings to streamline operations and enhance user experience. Terumo Corporation (JP) is also notable for its commitment to sustainability, which resonates with the growing demand for environmentally friendly medical solutions. Collectively, these strategies contribute to a dynamic competitive environment, where innovation and operational efficiency are paramount.In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and improve supply chain resilience. This approach is particularly relevant in a moderately fragmented market, where the collective influence of key players can significantly impact pricing and availability. The competitive structure is evolving, with companies leveraging their strengths to optimize supply chains and enhance product accessibility, thereby fostering a more interconnected market.

In November Becton Dickinson and Company (US) announced a partnership with a leading technology firm to develop a new line of smart syringes equipped with IoT capabilities. This strategic move is expected to enhance patient monitoring and data collection, aligning with the growing trend towards digital health solutions. The integration of IoT technology into syringes could potentially revolutionize how healthcare providers administer anesthesia, offering real-time insights and improving patient outcomes.

In October Medtronic plc (IE) launched a new initiative aimed at expanding its manufacturing capabilities in Europe. This expansion is designed to meet the increasing demand for anesthesia needles and syringes in the region, particularly in response to regulatory changes that favor locally produced medical devices. By enhancing its manufacturing footprint, Medtronic is likely to improve its supply chain efficiency and reduce lead times, positioning itself favorably against competitors.

In September Terumo Corporation (JP) unveiled a new eco-friendly syringe line, which utilizes biodegradable materials. This initiative not only addresses environmental concerns but also aligns with the company's broader sustainability goals. The introduction of such products may attract environmentally conscious healthcare providers and patients, thereby enhancing Terumo's market share in a competitive landscape that increasingly values sustainability.

As of December current trends in the anesthesia needles syringes Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are becoming more prevalent, as companies seek to combine their strengths to innovate and enhance product offerings. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology integration, and supply chain reliability. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex market.