Rising Surgical Procedures

The Anesthesia Machine Market is significantly influenced by the rising number of surgical procedures performed worldwide. As healthcare systems evolve, there is a notable increase in elective surgeries, minimally invasive procedures, and outpatient surgeries. This trend necessitates the use of advanced anesthesia machines to ensure patient safety and comfort during operations. Data indicates that the volume of surgical procedures is expected to rise by 10% annually, which directly correlates with the demand for anesthesia machines. Consequently, manufacturers are focusing on developing machines that are not only efficient but also adaptable to various surgical environments, thereby enhancing their market presence.

Increasing Focus on Patient Safety

In the Anesthesia Machine Market, there is an increasing emphasis on patient safety and risk management. Healthcare providers are prioritizing the implementation of anesthesia machines that incorporate safety features such as fail-safe mechanisms, alarms, and user-friendly interfaces. This focus on safety is driven by the need to minimize anesthesia-related complications and improve overall patient care. Recent studies suggest that hospitals investing in advanced anesthesia technology report a reduction in adverse events by up to 30%. As a result, the demand for high-quality anesthesia machines is likely to rise, prompting manufacturers to innovate and enhance their product offerings.

Regulatory Compliance and Standards

The Anesthesia Machine Market is shaped by stringent regulatory compliance and standards set by health authorities. These regulations ensure that anesthesia machines meet safety and efficacy requirements, which is crucial for gaining market approval. Manufacturers are compelled to invest in research and development to align their products with these evolving standards. The regulatory landscape is expected to become more rigorous, with an emphasis on quality assurance and post-market surveillance. This trend may lead to increased costs for manufacturers but also presents opportunities for those who can innovate and comply effectively, thereby enhancing their competitive edge in the market.

Growing Demand for Home Healthcare Solutions

The Anesthesia Machine Market is witnessing a growing demand for home healthcare solutions, particularly in the context of outpatient surgeries and remote monitoring. As healthcare shifts towards more patient-centric models, there is an increasing need for portable and user-friendly anesthesia machines that can be utilized in home settings. This trend is supported by advancements in telemedicine and remote patient monitoring technologies. Market data suggests that the segment for home healthcare anesthesia solutions is expected to grow by 15% over the next five years. This shift not only expands the market for anesthesia machines but also encourages manufacturers to develop innovative products tailored for home use.

Technological Innovations in Anesthesia Machines

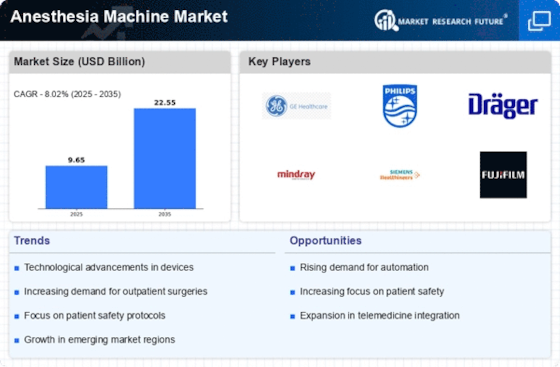

The Anesthesia Machine Market is experiencing a surge in technological innovations that enhance the efficiency and safety of anesthesia delivery. Advanced features such as integrated monitoring systems, automated drug delivery, and real-time data analytics are becoming standard in modern anesthesia machines. These innovations not only improve patient outcomes but also streamline workflows in operating rooms. According to recent data, the market for anesthesia machines is projected to grow at a compound annual growth rate of approximately 6.5% over the next several years. This growth is driven by the increasing demand for sophisticated anesthesia solutions that can cater to diverse surgical needs, thereby expanding the overall market landscape.