Rising Surgical Procedures

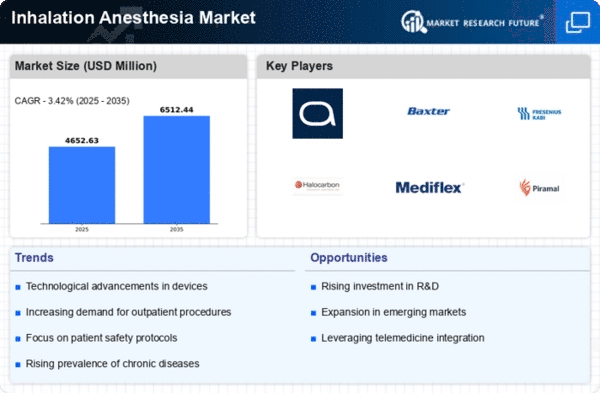

The increasing number of surgical procedures globally is a primary driver for the Global Inhalation Anesthesia Market Industry. As healthcare systems evolve and expand, the demand for surgical interventions rises, necessitating effective anesthesia solutions. In 2024, the market is valued at approximately 4.49 USD Billion, reflecting the growing reliance on inhalation anesthetics in various surgical settings. This trend is expected to continue, with projections indicating a market value of 6.5 USD Billion by 2035. The anticipated compound annual growth rate (CAGR) of 3.42% from 2025 to 2035 underscores the sustained demand for inhalation anesthesia in surgical practices.

Technological Advancements

Technological innovations in inhalation anesthesia equipment and delivery systems are significantly influencing the Global Inhalation Anesthesia Market Industry. Enhanced devices, such as advanced vaporizer systems and monitoring technologies, improve the safety and efficacy of anesthesia administration. These advancements not only facilitate better patient outcomes but also streamline the workflow in operating rooms. As hospitals and surgical centers adopt these modern technologies, the market is likely to experience growth. The integration of digital solutions and automation in anesthesia practices further supports the industry's expansion, aligning with the projected market growth from 4.49 USD Billion in 2024 to 6.5 USD Billion by 2035.

Growing Awareness and Training

The growing awareness of the importance of proper anesthesia management among healthcare professionals is a significant driver for the Global Inhalation Anesthesia Market Industry. Enhanced training programs and educational initiatives are being implemented to ensure that anesthesiologists and surgical teams are well-versed in the latest inhalation anesthesia techniques and technologies. This increased knowledge base contributes to improved patient outcomes and safety during surgical procedures. As more healthcare providers prioritize education and training in anesthesia practices, the demand for inhalation anesthetics is expected to rise, supporting the market's growth trajectory towards a projected value of 6.5 USD Billion by 2035.

Regulatory Support and Guidelines

Regulatory support and evolving guidelines for anesthesia practices play a pivotal role in shaping the Global Inhalation Anesthesia Market Industry. Governments and health organizations worldwide are establishing frameworks to ensure the safe and effective use of inhalation anesthetics. These regulations often promote the adoption of best practices and innovative technologies in anesthesia delivery. As healthcare facilities comply with these guidelines, the demand for high-quality inhalation anesthetics is likely to increase. This regulatory environment not only enhances patient safety but also contributes to the market's growth, aligning with the anticipated CAGR of 3.42% from 2025 to 2035.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases globally is a crucial factor driving the Global Inhalation Anesthesia Market Industry. Conditions such as cardiovascular diseases, respiratory disorders, and cancer often require surgical interventions, which in turn necessitate effective anesthesia management. As healthcare providers address these chronic conditions, the demand for inhalation anesthetics is expected to rise. This trend is particularly evident in aging populations, where the need for surgeries increases. The market's growth trajectory, with a projected value of 6.5 USD Billion by 2035, reflects the ongoing need for reliable anesthesia solutions in managing complex surgical cases associated with chronic diseases.