Android Stb Tv Size

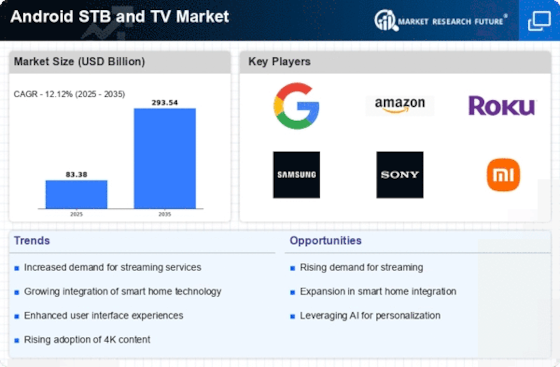

Android STB TV Market Growth Projections and Opportunities

The Android Set-Top Box (STB) and TV market are influenced by several key factors that shape its growth and evolution in the ever-changing landscape of home entertainment and digital media consumption. One significant factor driving the market is the increasing demand for smart TV solutions that offer enhanced connectivity, content access, and user experience. As consumers seek more integrated and interactive entertainment experiences, Android-based STBs and TVs provide a versatile platform for accessing streaming services, apps, games, and multimedia content directly on the television screen, eliminating the need for additional devices and simplifying the entertainment setup.

Moreover, the proliferation of Over-the-Top (OTT) streaming services and Video-on-Demand (VOD) platforms contributes to the growth of the Android STB and TV market. With the rise of subscription-based streaming services like Netflix, Amazon Prime Video, Disney+, and Hulu, consumers are shifting away from traditional cable and satellite TV subscriptions in favor of on-demand content delivered over the internet. Android-based STBs and smart TVs enable seamless integration with these streaming services, allowing users to access a vast library of movies, TV shows, and original content at their convenience, thereby driving adoption of Android-powered entertainment devices.

Furthermore, the increasing availability of high-speed internet connectivity and the growing penetration of broadband services worldwide fuel the demand for Android STBs and smart TVs. With reliable internet access becoming more widespread, consumers are embracing connected devices that enable them to stream content, browse the web, and engage with online services directly from their living room. Android-based STBs and TVs leverage internet connectivity to offer features such as video streaming, social media integration, online gaming, and cloud storage, enhancing the entertainment and multimedia capabilities of traditional television sets.

Additionally, the affordability and accessibility of Android-based STBs and smart TVs make them attractive options for consumers across diverse demographics and income levels. Unlike proprietary smart TV platforms that may come with premium price tags, Android-based devices offer a range of options at various price points, catering to different budget constraints and preferences. This accessibility democratizes access to smart TV features and internet-connected entertainment, enabling a broader audience to enjoy the benefits of a connected home entertainment ecosystem.

Moreover, the customization and flexibility of the Android platform drive innovation and differentiation in the STB and TV market. Android's open-source nature allows manufacturers and developers to customize and tailor the user interface, features, and content offerings of their devices to suit specific market segments and consumer preferences. This flexibility enables device makers to differentiate their products through unique user experiences, value-added services, and partnerships with content providers, app developers, and ecosystem partners, driving competition and innovation in the Android STB and TV market.

Furthermore, the integration of voice control, artificial intelligence, and smart home functionality enhances the appeal and functionality of Android-based STBs and smart TVs. Voice-enabled remote controls, virtual assistants like Google Assistant, and smart home integration capabilities allow users to control their entertainment experience, access information, and interact with connected devices using voice commands and natural language processing. These features enhance convenience, accessibility, and user engagement, making Android-powered entertainment devices more intuitive and user-friendly for consumers.

Additionally, the expansion of the Android ecosystem beyond traditional entertainment content to include gaming, education, lifestyle, and productivity applications broadens the appeal and use cases of Android-based STBs and smart TVs. With access to the Google Play Store and a vast library of apps and games, Android-powered entertainment devices offer a diverse range of entertainment, educational, and lifestyle experiences that cater to different interests and demographics. This diversity of content and applications enriches the value proposition of Android STBs and TVs, making them versatile hubs for entertainment, information, and digital interaction in the home.

Leave a Comment