Ammonia Size

Market Size Snapshot

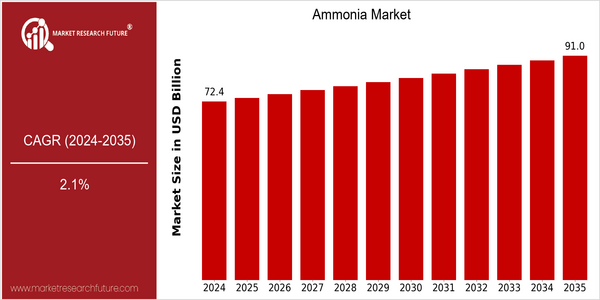

| Year | Value |

|---|---|

| 2024 | USD 72.38 Billion |

| 2035 | USD 91.0 Billion |

| CAGR (2025-2035) | 2.1 % |

Note – Market size depicts the revenue generated over the financial year

In 2024, the global ammonia market is expected to reach a size of USD 72.38 billion, and is projected to reach a size of USD 91.0 billion by 2035. This growth reflects a CAGR of 2.1% between 2025 and 2035. The growth of the market can be attributed to several factors, such as the increasing demand for fertilizers in the agricultural sector, which is the main source of ammonia consumption. Besides this, the growing focus on sustainable agriculture and the development of green ammonia technology are driving the market. The growing use of renewable energy sources in the production of ammonia is also contributing to the growth of the market. In the future, the market will be led by Yara International and CF Industries, which are investing in sustainable production and developing new products. These efforts not only support the companies' global environmental goals, but also put them in a good position in the competitive landscape, ensuring that they remain in the forefront of the ammonia market.

Regional Market Size

Regional Deep Dive

The ammonia market is characterized by its key role in agriculture, particularly as a fertilizer, and is influenced by various regional dynamics. In North America, the market is driven by a strong agricultural sector and technological innovations in farming. Europe focuses on sustainability and compliance. In Asia-Pacific, rapid urbanization and industrialization are expected to drive demand. In the Middle East and Africa, natural gas resources are being utilized to produce ammonia. The Latin American region is experiencing growth owing to its expanding agricultural sector. Each region has its own set of opportunities and challenges that define the market.

Europe

- The European Union's Green Deal aims to make Europe climate-neutral by 2050, prompting ammonia producers to adopt greener technologies and reduce carbon footprints.

- Companies such as Yara International are leading initiatives to develop ammonia as a hydrogen carrier, aligning with the EU's hydrogen strategy and promoting renewable energy integration.

Asia Pacific

- China remains the largest producer and consumer of ammonia, with recent government policies encouraging the use of ammonia in clean energy applications, such as fuel cells.

- India is ramping up its ammonia production capabilities through projects like the Talcher Fertilizer Plant, which aims to utilize coal gasification technology to produce ammonia sustainably.

Latin America

- Brazil is increasing its ammonia production capacity to reduce dependency on imports, with investments in new fertilizer plants aimed at supporting its agricultural sector.

- Regulatory changes in Argentina are encouraging the use of ammonia in renewable energy projects, which is expected to diversify its applications beyond traditional fertilizers.

North America

- The North American ammonia market is experiencing a shift towards more sustainable production methods, with companies like CF Industries investing in carbon capture technologies to reduce emissions.

- The U.S. government has introduced incentives for green ammonia production, which is expected to drive innovation and attract investments in the sector.

Middle East And Africa

- The Middle East is leveraging its abundant natural gas reserves to produce ammonia at competitive prices, with companies like SABIC expanding their production facilities.

- In Africa, initiatives such as the African Development Bank's 'Feed Africa' strategy are promoting ammonia use in agriculture to enhance food security and boost local economies.

Did You Know?

“Ammonia is not only a key ingredient in fertilizers but also plays a significant role in the production of plastics, explosives, and even refrigerants.” — International Fertilizer Association

Segmental Market Size

The ammonia market is currently growing steadily, driven primarily by its indispensable role in agriculture as the most important fertilizer. In addition, the increasing population and the consequently growing demand for food production are influencing the development of the market. In addition, the implementation of the so-called “climate policy” by the authorities is pushing the industry towards more sustainable ammonia production, such as hydrogen technology. Yara International and Siemens are currently leading the development of hydrogen-based ammonia production in Europe and North America. The main applications of ammonia are fertilizer for agriculture, chemicals, and energy storage. Among the notable trends are the demand for green ammonia and the carbon footprint policy of the authorities. The development of the industry is characterized by the introduction of more efficient and sustainable production methods such as hydrogen production and carbon capture.

Future Outlook

Ammonia market will show a steady growth from 2024 to 2035. The market value is expected to increase from $72.38 billion to $91.09 billion, with a CAGR of 2.1%. The main reason is the rising demand for ammonia in various applications, especially in fertilizers, which accounted for 80% of the total consumption of ammonia. The population is increasing, and the demand for food is increasing, which will drive the demand for ammonia. Especially in the developing countries, the level of agricultural production is still low, and there is a great need to increase agricultural production, which is also the driving force of the development of ammonia. The second reason is that the world has been paying more attention to food security and the development of sustainable agriculture. Ammonia is an important nitrogen source in fertilizers. This will also promote the development of ammonia. The third reason is the technical progress and policy support. The production of green ammonia has been popularized, especially the green ammonia produced by renewable energy. The use of ammonia is more and more popular. The use of ammonia is more and more popular. The technical progress has also been very prominent, such as the use of hydrogen as a nitrogen source, and the use of nitrogen from urea. The trend of the world is also developing towards a low-carbon economy, which is also in line with the sustainable development of the world. The government has also put forward some policies to reduce greenhouse gas emissions and encourage green energy solutions. The trend of integrating hydrogen production with ammonia as a carbon-free fuel will also drive the market.

Leave a Comment