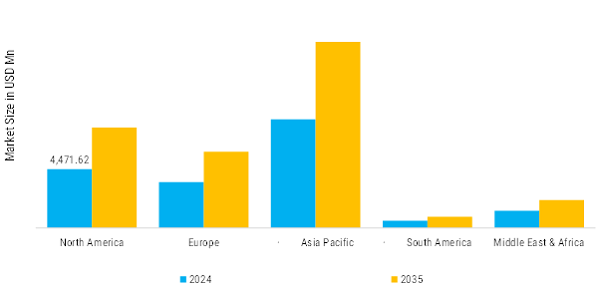

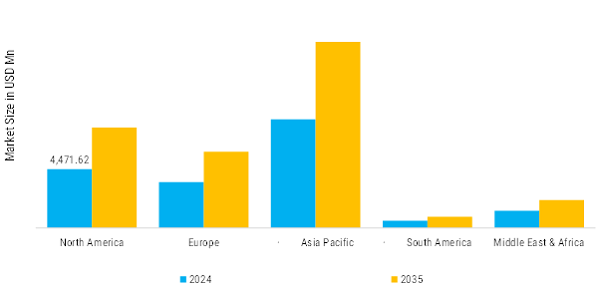

North America: Growth Amines

In North America, the supply of amines is predominantly driven by established chemical manufacturing hubs in the United States and Canada. Major producers in this region include both global chemical companies and regional players, who supply amines for pharmaceuticals, agriculture, and industrial applications. North America’s industrial and chemical markets. The supply chain in this region remains relatively stable, but future supply disruptions could arise due to trade tensions, raw material costs, or environmental regulations.

Europe: Emerging Amines production

Europe’s supply of amines is robust, with several key chemical manufacturing countries, including Germany, France, and the Netherlands, serving as primary production hubs. The European market is heavily integrated with global supply chains, allowing access to amines produced both domestically and through imports, particularly from the Middle East and Asia. The region’s supply is characterized by high standards for product quality and regulatory compliance, especially for applications in pharmaceuticals, textiles, and personal care. The European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations have prompted stricter controls over chemical production, ensuring that only safe, high-quality amines are used. While Europe is largely self-sufficient in amine production, the increasing demand for specialty amines, particularly in biotech and pharma, may lead to a rise in imports from other regions to meet the specialized requirements.

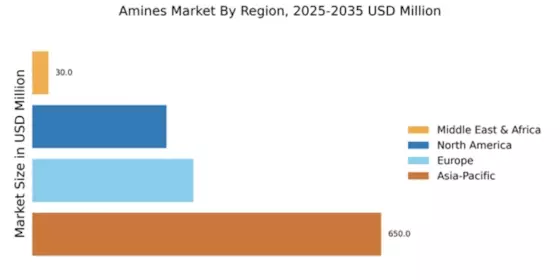

Asia-Pacific: Rapidly Growing producer and consumer Amines

Asia-Pacific is both the large producer and consumer of amines globally, led by China and India. The region benefits from large-scale petrochemical production, lower labour costs, and established infrastructure, which positions it as the dominant supplier of amines for industrial, agricultural, and pharmaceutical applications. The growing demand for high-performance amines in the automotive, agriculture, and personal care industries has also bolstered regional supply. However, supply in the region faces challenges such as air and water pollution regulations, volatility in raw material prices, and the risk of supply chain disruptions due to geopolitical tensions, such as the U.S.-China trade war.

Middle East and Africa: Emerging Amine Supply

The Middle East, particularly countries like Saudi Arabia and the UAE, has a well-established petrochemical industry that supports a strong amine supply. The region's advantage lies in its access to inexpensive raw materials derived from oil and natural gas, making amines production relatively cost-effective. However, the supply of amines in the Middle East is often oriented toward industrial applications, such as in the production of fertilizers, petrochemicals, and textiles. As demand grows for industrial and agricultural products, and with increasing investments in pharmaceutical infrastructure in Africa, imports of amines are expected to rise.

South America: Growth rapidly Amines

South America’s amine supply is primarily concentrated in Brazil and Argentina, which have the most developed chemical manufacturing sectors in the region. While these countries are capable of producing a range of amines, their domestic production is often insufficient to meet local demand, particularly for high-purity or specialty grades of amines. As a result, South American countries rely on imports from North America, Europe, and Asia to fill the supply gap. The demand for amines in the region is primarily driven by the agricultural and industrial sectors, with increasing applications in pharmaceuticals and personal care. However, the supply chain in South America can be vulnerable to fluctuations in commodity prices, political instability, and logistical challenges, such as transportation inefficiencies and infrastructure limitations.