Electrification Trends

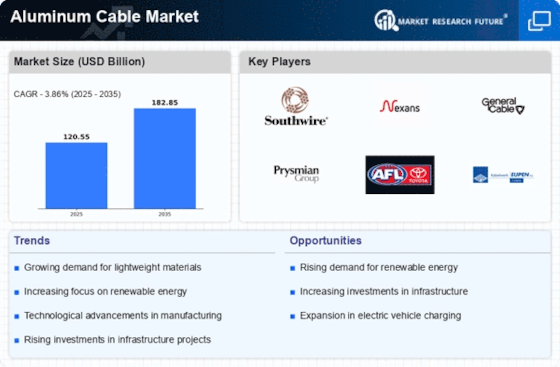

Electrification trends are emerging as a key driver for the Aluminum Cable Market. As more regions seek to enhance their electrical infrastructure, the demand for reliable and efficient cable solutions is surging. The push for electrification in rural and underserved areas is particularly noteworthy, as it aims to improve access to electricity for millions. In 2025, the electrification initiatives are expected to contribute to a market growth rate of approximately 12%. Aluminum cables, known for their cost-effectiveness and performance, are likely to play a crucial role in these initiatives, thereby bolstering the Aluminum Cable Market.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Aluminum Cable Market. Innovations in manufacturing processes, such as improved alloy compositions and enhanced insulation techniques, are leading to the production of more efficient and durable aluminum cables. These advancements not only enhance performance but also reduce production costs, making aluminum cables more competitive against traditional materials. In 2025, the market is expected to witness a growth rate of around 10% as new technologies emerge, enabling manufacturers to cater to diverse applications, including telecommunications and power distribution. The integration of smart technologies into cable systems further indicates a promising future for the Aluminum Cable Market.

Growth in Renewable Energy

The growth in renewable energy sources is significantly influencing the Aluminum Cable Market. As countries strive to transition to cleaner energy solutions, the demand for aluminum cables in solar and wind energy applications is on the rise. Aluminum's lightweight and conductive properties make it an ideal choice for renewable energy systems, facilitating efficient energy transmission. In 2025, the renewable energy sector is projected to expand by over 20%, leading to increased utilization of aluminum cables in energy generation and distribution. This trend not only supports the Aluminum Cable Market but also aligns with global efforts to reduce reliance on fossil fuels.

Infrastructure Development

Infrastructure development remains a critical driver for the Aluminum Cable Market. With urbanization and population growth, there is an increasing need for robust electrical and communication networks. Governments and private sectors are investing heavily in infrastructure projects, including transportation, energy, and telecommunications. In 2025, the global infrastructure spending is anticipated to reach trillions of dollars, significantly boosting the demand for aluminum cables. These cables are favored for their lightweight properties and excellent conductivity, making them ideal for various applications. As infrastructure projects expand, the Aluminum Cable Market is likely to benefit from sustained demand.

Sustainability Initiatives

The Aluminum Cable Market is experiencing a notable shift towards sustainability initiatives. As environmental concerns gain prominence, industries are increasingly adopting aluminum cables due to their recyclability and lower carbon footprint compared to copper alternatives. This trend is further supported by regulatory frameworks that encourage the use of sustainable materials in construction and electrical applications. In 2025, the demand for aluminum cables is projected to rise by approximately 15%, driven by the construction sector's commitment to green building practices. The emphasis on reducing environmental impact is likely to propel the Aluminum Cable Market forward, as manufacturers innovate to meet these sustainability goals.

Leave a Comment