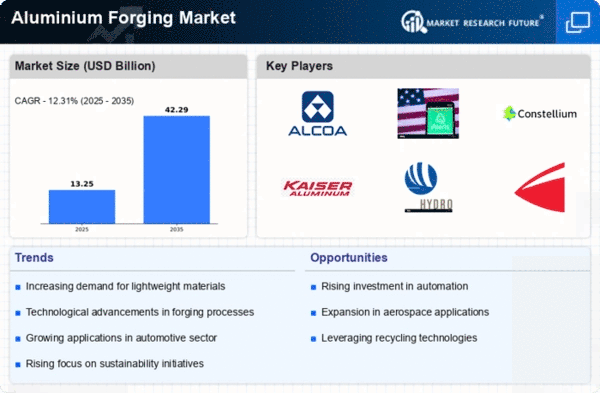

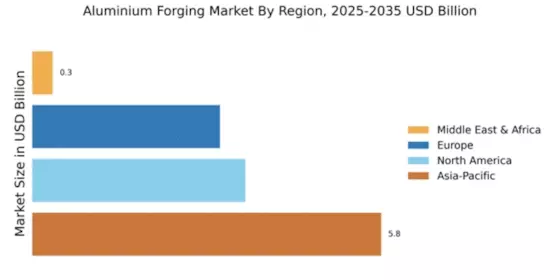

North America : Established Market with Growth Potential

The North American aluminium forging market, valued at $3.54 billion, is driven by increasing demand in aerospace, automotive, and construction sectors. Regulatory support for lightweight materials and sustainability initiatives further catalyze growth. The region's focus on innovation and advanced manufacturing technologies is expected to enhance production efficiency and product quality, contributing to market expansion.

Leading countries like the US and Canada dominate the landscape, with key players such as Alcoa Corporation and Kaiser Aluminum Corporation driving competition. The presence of established manufacturers and a robust supply chain fosters a conducive environment for growth. As the market evolves, investments in R&D and strategic partnerships will be crucial for maintaining competitive advantage.

Europe : Innovation and Sustainability Focus

Europe's aluminium forging market, valued at $3.12 billion, is characterized by a strong emphasis on sustainability and innovation. The region is witnessing a shift towards lightweight materials in automotive and aerospace applications, driven by stringent environmental regulations. This trend is expected to propel market growth as manufacturers adapt to meet evolving consumer demands and regulatory standards.

Countries like Germany, France, and the UK are at the forefront, with key players such as Constellium SE and Norsk Hydro ASA leading the charge. The competitive landscape is marked by collaborations and technological advancements aimed at enhancing product offerings. As the market matures, the focus on recycling and sustainable practices will play a pivotal role in shaping future growth trajectories.

Asia-Pacific : Rapid Growth and Market Leadership

Asia-Pacific, with a market size of $5.8 billion, is the largest region for aluminium forging, driven by robust industrial growth and increasing demand from automotive and aerospace sectors. The region's rapid urbanization and infrastructure development are significant growth catalysts. Additionally, favorable government policies and investments in manufacturing capabilities are expected to sustain this upward trajectory in the coming years.

China, Japan, and India are leading countries in this market, with major players like UACJ Corporation and Precision Castparts Corp. establishing a strong foothold. The competitive landscape is characterized by a mix of local and international firms, fostering innovation and efficiency. As the region continues to expand, the focus on advanced technologies and sustainable practices will be crucial for maintaining market leadership.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa's aluminium forging market, valued at $0.34 billion, is in its nascent stages but shows significant growth potential. The region's increasing investments in infrastructure and construction projects are driving demand for aluminium products. Additionally, government initiatives aimed at diversifying economies and promoting manufacturing are expected to catalyze market growth in the coming years.

Countries like the UAE and South Africa are leading the charge, with a growing number of local and international players entering the market. The competitive landscape is evolving, with companies focusing on establishing production facilities to meet local demand. As the market matures, strategic partnerships and investments in technology will be essential for capturing growth opportunities.