Rising Fuel Efficiency Standards

The All-Weather Tire Market is also influenced by the rising fuel efficiency standards imposed by various regulatory bodies. As governments worldwide implement stricter regulations to reduce carbon emissions, manufacturers are compelled to innovate and produce tires that not only meet these standards but also enhance vehicle performance. All-weather tires, designed to provide optimal grip and lower rolling resistance, can contribute to improved fuel efficiency. This is particularly relevant as consumers become more environmentally conscious and seek products that align with their values. The integration of advanced materials and technologies in all-weather tire design may further enhance their appeal, potentially leading to increased market penetration.

Growing Awareness of Climate Change

The growing awareness of climate change is influencing consumer choices within the All-Weather Tire Market. As individuals become more conscious of their environmental impact, there is a shift towards products that promote sustainability. All-weather tires, which can reduce the need for multiple tire sets, align with this trend by minimizing resource consumption and waste. Furthermore, manufacturers are increasingly adopting eco-friendly materials and production methods, which may appeal to environmentally aware consumers. This shift in consumer behavior could lead to a rise in demand for all-weather tires, as they represent a more sustainable option in the automotive sector.

Consumer Preference for Cost-Effectiveness

Cost-effectiveness is a driving force in the All-Weather Tire Market, as consumers increasingly seek value in their purchases. All-weather tires offer a practical solution by eliminating the need for seasonal tire changes, thereby reducing overall maintenance costs. This financial advantage resonates with budget-conscious consumers who are looking to maximize their investments. Market data suggests that the total cost of ownership for vehicles equipped with all-weather tires can be lower compared to those requiring separate winter and summer tires. As consumers become more discerning about their spending, the appeal of all-weather tires as a cost-effective alternative is likely to grow, potentially boosting market demand.

Increasing Urbanization and Mobility Needs

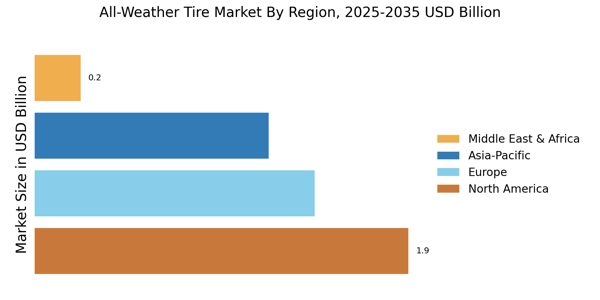

The All-Weather Tire Market is experiencing a notable surge due to increasing urbanization and the corresponding mobility needs of consumers. As urban areas expand, the demand for versatile tire solutions that can perform well in diverse weather conditions becomes paramount. This trend is particularly evident in regions where consumers seek to minimize the number of tire changes throughout the year. The convenience of all-weather tires aligns with the fast-paced lifestyle of urban dwellers, who often prioritize efficiency and practicality. Furthermore, data indicates that urban populations are projected to grow significantly, which may further drive the demand for all-weather tires as consumers look for reliable and adaptable options for their vehicles.

Technological Innovations in Tire Manufacturing

Technological innovations play a crucial role in shaping the All-Weather Tire Market. Advances in tire manufacturing processes, such as the use of advanced polymers and innovative tread designs, enhance the performance and durability of all-weather tires. These innovations not only improve traction and handling in various weather conditions but also extend the lifespan of the tires. As manufacturers continue to invest in research and development, the introduction of high-performance all-weather tires is expected to attract a broader consumer base. The ability to offer tires that perform reliably in both wet and dry conditions may position all-weather tires as a preferred choice among consumers, thereby driving market growth.