Emerging Markets and Urbanization

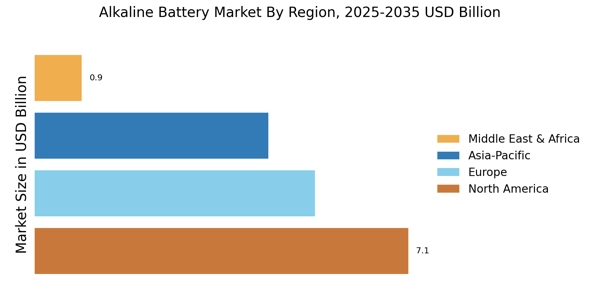

Emerging markets and urbanization are pivotal factors influencing the Alkaline Battery Market. As urban populations grow, the demand for household and personal electronic devices increases, subsequently driving the need for alkaline batteries. In 2025, urbanization rates in developing regions are projected to rise, leading to a surge in consumer spending on electronics. This trend suggests that manufacturers in the alkaline battery market must strategically position themselves to capitalize on the opportunities presented by these emerging markets. The Alkaline Battery Market is likely to experience growth as urban consumers seek reliable power solutions for their devices.

Growth in Consumer Electronics Sector

The consumer electronics sector continues to expand, contributing to the growth of the Alkaline Battery Market. With advancements in technology, devices such as remote controls, toys, and gaming consoles increasingly rely on alkaline batteries for power. In 2025, the consumer electronics market is expected to surpass 1 trillion dollars, creating a substantial demand for alkaline batteries. This growth suggests that manufacturers must innovate and enhance their product offerings to cater to the diverse needs of consumers. The Alkaline Battery Market stands to gain from this trend, as it aligns with the increasing reliance on battery-operated devices.

Rising Demand for Portable Electronics

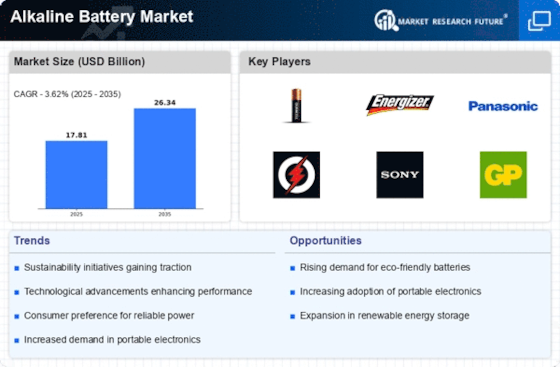

The increasing prevalence of portable electronic devices, such as smartphones, tablets, and wearable technology, drives the Alkaline Battery Market. As consumers seek reliable power sources for their gadgets, the demand for alkaline batteries is expected to rise. In 2025, the market for portable electronics is projected to reach approximately 1.5 billion units, indicating a robust growth trajectory. This trend suggests that manufacturers in the alkaline battery sector must adapt to meet the evolving needs of consumers who prioritize convenience and performance. The Alkaline Battery Market is likely to benefit from this surge in demand, as these batteries are favored for their longevity and efficiency in powering portable devices.

Environmental Regulations and Standards

The Alkaline Battery Market is influenced by evolving environmental regulations and standards aimed at reducing waste and promoting recycling. Governments worldwide are implementing stricter guidelines for battery disposal and recycling, which could impact the production and consumption of alkaline batteries. In 2025, compliance with these regulations may drive manufacturers to invest in more sustainable practices, potentially leading to the development of eco-friendly alkaline batteries. This shift could enhance the market's appeal to environmentally conscious consumers, thereby fostering growth within the alkaline battery sector.

Increased Focus on Renewable Energy Solutions

The Alkaline Battery Industry. As more households and businesses adopt solar energy systems, the need for efficient energy storage solutions becomes paramount. Alkaline batteries, known for their reliability and cost-effectiveness, are increasingly being utilized in conjunction with renewable energy systems. In 2025, the market for energy storage solutions is anticipated to grow significantly, with alkaline batteries playing a crucial role in this transition. This trend indicates a potential expansion of the alkaline battery market as consumers and businesses seek sustainable energy alternatives.