Increased Use in Agriculture

The Global Aldehyde Market Industry is experiencing increased utilization of aldehydes in agricultural applications, particularly as pesticides and herbicides. Aldehydes such as formaldehyde are recognized for their efficacy in pest control and soil treatment, contributing to enhanced crop yields. The growing global population and the corresponding demand for food production are driving this trend. As agricultural practices evolve, the reliance on chemical solutions, including aldehydes, is likely to expand. This shift may further solidify the market's position, as stakeholders seek effective solutions to meet agricultural challenges.

Growth in Personal Care Products

The Global Aldehyde Market Industry is witnessing a robust growth trajectory due to the rising incorporation of aldehydes in personal care products. Aldehydes are utilized for their fragrance properties and as preservatives in cosmetics and skincare formulations. With the global personal care market projected to reach unprecedented levels, the demand for aldehydes is expected to rise correspondingly. This sector's expansion is anticipated to play a crucial role in driving the market, potentially leading to a valuation of 6.71 USD Billion by 2035. The increasing consumer preference for high-quality personal care items further supports this trend.

Rising Demand in Pharmaceuticals

The Global Aldehyde Market Industry experiences a notable surge in demand from the pharmaceutical sector, driven by the increasing use of aldehydes in drug formulation and synthesis. Aldehydes such as formaldehyde and acetaldehyde serve as key intermediates in the production of various medications, including analgesics and antibiotics. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 3 USD Billion in 2024. As the pharmaceutical industry continues to expand globally, the reliance on aldehydes for innovative drug development is likely to enhance their market presence.

Emerging Markets and Economic Growth

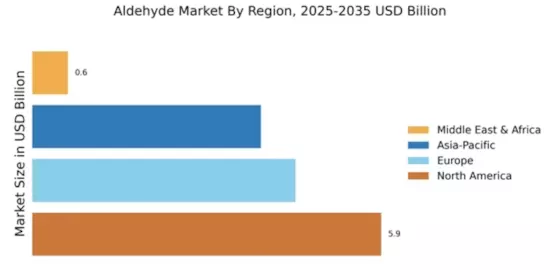

The Global Aldehyde Market Industry is poised for expansion in emerging markets, where economic growth is fostering increased industrial activity. Countries in Asia-Pacific and Latin America are witnessing a rise in manufacturing sectors, which in turn drives the demand for aldehydes in various applications, including textiles and plastics. As these economies develop, the consumption of aldehydes is expected to rise, contributing to the overall market growth. This trend indicates a potential for significant market opportunities in regions that are currently underrepresented in the global aldehyde landscape.

Advancements in Chemical Manufacturing

The Global Aldehyde Market Industry benefits from advancements in chemical manufacturing processes that enhance the efficiency and yield of aldehyde production. Innovations such as catalytic processes and green chemistry techniques are being adopted to reduce waste and improve sustainability. These advancements not only lower production costs but also align with global environmental regulations, making aldehydes more appealing to manufacturers. As a result, the market is poised for growth, with a projected compound annual growth rate of 7.59% from 2025 to 2035. This trend indicates a shift towards more sustainable practices in the chemical industry.