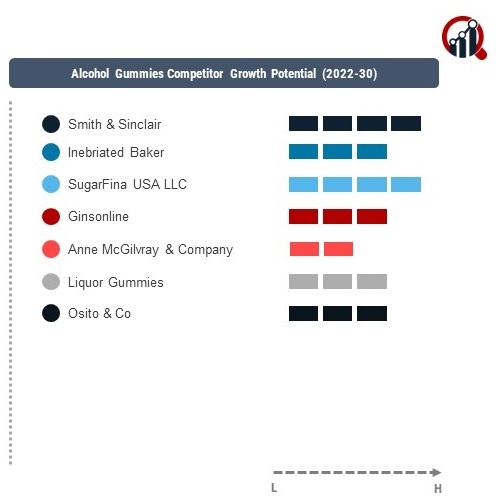

Top Industry Leaders in the Alcohol Gummies Market

Strategies Adopted by Alcohol Gummies Key Players

The competitive landscape of the alcohol gummies market has witnessed significant activity, reflecting the growing demand for innovative and enjoyable alcoholic products. As of 2023, the market is characterized by a mix of established players and new entrants vying for consumer attention in this niche segment. Key aspects shaping the competitive dynamics include the list of key players, strategies adopted, factors influencing market share analysis, the emergence of new companies, industry news, current company performance, investment trends, overall competitive scenario, and recent developments.

Key Players:

- Smith & Sinclair,

- Inebriated Baker,

- SugarFina USA LLC,

- Ginsonline,

- Anne Mc

- Gilvray & Company,

- Liquor Gummies, Osito & Co

Strategies Adopted:

Key players in the alcohol gummies market deploy various strategies to gain a competitive edge. Product innovation is a common approach, with companies introducing new flavors, formulations, and packaging to attract consumers. Collaborations with beverage companies and strategic partnerships with retailers are also prevalent strategies to expand distribution channels. Marketing efforts often focus on creating a lifestyle brand image, targeting the millennial and Gen Z demographics who are particularly drawn to novel and experiential alcoholic products.

Factors for Market Share Analysis:

Market share analysis in the alcohol gummies market is influenced by factors such as brand recognition, flavor variety, pricing, and distribution channels. Established players benefit from strong brand equity and consumer trust, allowing them to maintain a substantial market share. However, factors like pricing competitiveness and the ability to adapt to changing consumer preferences also play a crucial role. Effective marketing campaigns that resonate with the target audience contribute to increased market share for both established and emerging players.

New and Emerging Companies:

The alcohol gummies market has witnessed the emergence of new companies seeking to capitalize on the trend of alternative alcoholic products. Startups like Tipsy Scoop and Candy Mechanics are bringing fresh perspectives to the market, introducing innovative alcoholic candy and gummy offerings. These companies often focus on organic and natural ingredients, catering to consumers who prioritize quality and authenticity. Their nimble structures and agility allow them to experiment with flavors and adapt quickly to changing market demands.

Industry News and Current Company Performance:

Ongoing industry news and the current performance of companies are crucial aspects influencing the competitive landscape. Recent partnerships between alcohol gummy manufacturers and established liquor brands have been noteworthy, aiming to leverage the popularity of both segments. Additionally, tracking current company performance, including sales figures and market penetration, provides insights into market trends and consumer preferences, guiding strategic decisions for players in this space.

Investment Trends:

The alcohol gummies market has attracted attention from investors seeking to capitalize on the growth of alternative alcoholic products. Investment trends include funding for product development, marketing initiatives, and expansion into new markets. Venture capital firms and private equity players are actively participating in funding rounds for emerging companies that demonstrate potential for market disruption. The investment landscape reflects confidence in the sustained growth of the alcohol gummies market and the potential for significant returns.

Overall Competitive Scenario:

The overall competitive scenario in the alcohol gummies market is marked by a balance between established players and new entrants. Established brands hold a certain advantage due to their brand recognition and existing consumer base. However, the market's dynamic nature allows agile and innovative newcomers to challenge the status quo. The ability to adapt to changing consumer preferences, introduce unique flavors, and effectively market products plays a pivotal role in shaping the competitive landscape.

Recent Development

The alcohol gummies market witnessed a significant development with Project 7, a key player, announcing a strategic collaboration with a renowned spirits brand. This partnership aims to create a synergistic fusion of flavors, leveraging the strengths of both entities to introduce a range of premium alcohol gummies. This development reflects a broader trend in the industry where collaborations between confectionery manufacturers and established liquor brands aim to elevate the overall consumer experience. Such strategic alliances are poised to influence the competitive landscape, providing opportunities for mutual growth and market expansion.

- Beta

Beta feature