Growth in Coating Applications

The AKD Emulsifier Market is witnessing significant growth due to the increasing utilization of emulsifiers in coating applications. The coatings sector, which includes paints, inks, and surface treatments, is projected to expand at a compound annual growth rate of around 4% through 2025. AKD emulsifiers are favored for their ability to enhance the stability and performance of coatings, providing superior water resistance and durability. This growth in the coatings market is likely to bolster the demand for AKD emulsifiers, as manufacturers strive to meet the evolving needs of consumers for high-quality, long-lasting products.

Expansion of the Textile Industry

The AKD Emulsifier Market is poised for growth due to the expansion of the textile industry, which increasingly relies on emulsifiers for various applications. The textile sector is projected to grow at a rate of approximately 5% annually, driven by rising consumer demand for innovative fabrics and finishes. AKD emulsifiers are essential in textile processing, providing benefits such as improved water repellency and enhanced dye uptake. This growth in the textile industry is likely to create new opportunities for the AKD Emulsifier Market, as manufacturers seek to enhance product performance and meet consumer expectations.

Rising Demand for Paper and Packaging

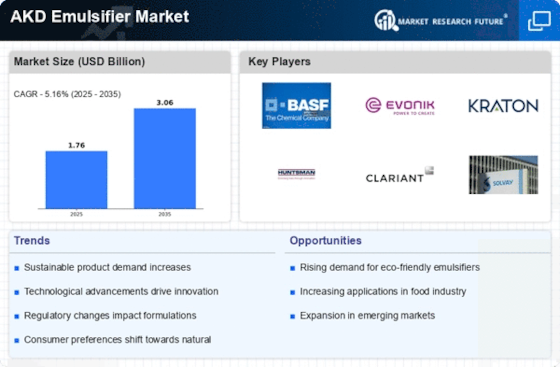

The AKD Emulsifier Market is experiencing a notable increase in demand driven by the expanding paper and packaging sector. As industries prioritize sustainable packaging solutions, the need for effective emulsifiers like AKD has surged. In 2025, The AKD Emulsifier Market is projected to reach approximately 500 billion USD, with AKD emulsifiers playing a crucial role in enhancing the quality and performance of paper products. This trend indicates a robust growth trajectory for the AKD Emulsifier Market, as manufacturers seek to improve product characteristics such as water resistance and printability, which are essential for modern packaging applications.

Technological Innovations in Emulsifier Production

The AKD Emulsifier Market is benefiting from ongoing technological innovations in the production of emulsifiers. Advances in manufacturing processes and formulations are enabling the development of more efficient and effective AKD emulsifiers. These innovations not only improve the performance characteristics of emulsifiers but also enhance their environmental compatibility. As the industry moves towards greener production methods, the demand for high-performance AKD emulsifiers is expected to rise. This trend suggests a promising future for the AKD Emulsifier Market, as companies invest in research and development to create superior products that align with sustainability goals.

Increasing Regulatory Support for Sustainable Products

The AKD Emulsifier Market is positively influenced by increasing regulatory support for sustainable and eco-friendly products. Governments and regulatory bodies are implementing stricter guidelines aimed at reducing environmental impact, which encourages manufacturers to adopt sustainable practices. This shift is likely to drive the demand for AKD emulsifiers, as they are often derived from renewable resources and contribute to the production of biodegradable products. The alignment of AKD emulsifiers with sustainability initiatives positions the market favorably, suggesting a potential increase in market share as companies seek compliant and environmentally responsible solutions.