Government Initiatives and Regulations

Government initiatives and regulations play a pivotal role in shaping the Airport Biometrics Market. Many countries are implementing policies that encourage the adoption of biometric technologies to enhance border control and immigration processes. For instance, the introduction of e-passports and automated border control systems has led to increased investments in biometric solutions. These initiatives not only aim to improve security but also to facilitate smoother passenger flow. As a result, the market is expected to witness substantial growth, with estimates suggesting a potential increase in market size by 20% over the next five years due to supportive government frameworks.

Increasing Demand for Enhanced Security

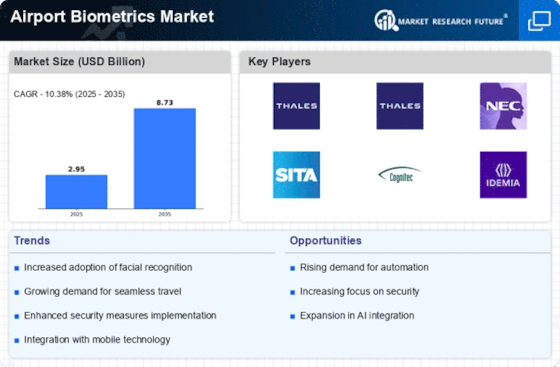

The Airport Biometrics Market is experiencing a notable surge in demand for enhanced security measures. As air travel continues to grow, airports are increasingly prioritizing passenger safety and security. The implementation of biometric technologies, such as facial recognition and fingerprint scanning, provides a robust solution to mitigate security risks. According to recent data, the market for biometric systems in airports is projected to reach USD 3 billion by 2026, reflecting a compound annual growth rate of approximately 15%. This trend indicates that airports are investing significantly in biometric solutions to streamline security processes while ensuring a secure environment for travelers.

Rising Passenger Volume and Travel Frequency

The Airport Biometrics Market is also driven by the rising passenger volume and travel frequency. With an increasing number of individuals traveling for business and leisure, airports are under pressure to enhance their operational efficiency. Biometric technologies offer a solution to manage the growing influx of passengers by expediting check-in, security screening, and boarding processes. Recent statistics indicate that air travel is expected to grow by 4% annually, leading to a projected increase in the number of passengers passing through airports. This trend suggests that the demand for biometric solutions will continue to rise as airports strive to accommodate higher passenger volumes while maintaining security.

Technological Advancements in Biometric Solutions

Technological advancements are significantly influencing the Airport Biometrics Market. Innovations in biometric technologies, such as improved algorithms for facial recognition and iris scanning, are enhancing the accuracy and efficiency of these systems. The integration of artificial intelligence and machine learning is further optimizing biometric processes, allowing for faster identification and verification of passengers. As airports seek to modernize their operations, the demand for advanced biometric solutions is likely to rise. Market analysts project that the adoption of these technologies could lead to a 30% increase in efficiency in passenger processing times, thereby improving overall airport operations.

Consumer Preference for Seamless Travel Experiences

Consumer preferences are shifting towards seamless travel experiences, which is a significant driver for the Airport Biometrics Market. Passengers increasingly favor technologies that reduce wait times and enhance convenience during their journey. Biometric solutions, such as facial recognition at check-in and boarding gates, cater to this demand by providing a contactless and efficient travel experience. As travelers become more accustomed to these technologies, their expectations for speed and convenience will likely drive further adoption of biometric systems in airports. Market trends suggest that by 2027, nearly 70% of airports may implement biometric solutions to meet evolving consumer demands.