Increased Competition

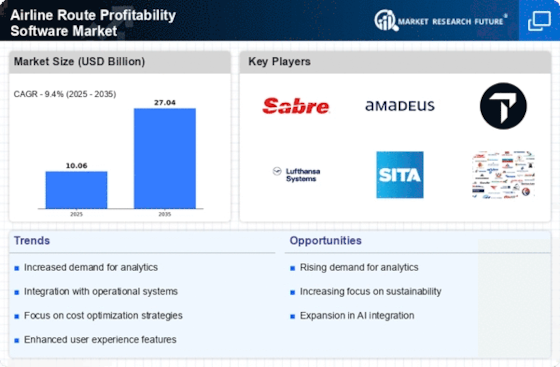

The airline route profitability software Market is significantly influenced by the intensifying competition among airlines. As new entrants emerge and existing carriers expand their networks, the need for strategic route planning becomes paramount. Airlines are increasingly adopting profitability software to gain a competitive edge by identifying lucrative routes and optimizing their schedules. Market data suggests that airlines utilizing such software can enhance their revenue by up to 10% through better route selection and pricing strategies. This competitive landscape compels airlines to invest in technology that not only streamlines operations but also maximizes profitability, thereby propelling the growth of the Airline Route Profitability Software Market.

Rising Operational Costs

The Airline Route Profitability Software Market is experiencing a surge in demand due to the rising operational costs faced by airlines. As fuel prices fluctuate and maintenance expenses increase, airlines are compelled to seek solutions that enhance profitability. This software enables airlines to analyze route performance, optimize pricing strategies, and reduce unnecessary expenditures. According to recent data, operational costs for airlines have risen by approximately 5% annually, prompting a shift towards more efficient route management. By leveraging advanced analytics, airlines can identify underperforming routes and make informed decisions to improve overall profitability. This trend indicates a growing reliance on software solutions that provide actionable insights, thereby driving the Airline Route Profitability Software Market forward.

Focus on Customer Experience

The Airline Route Profitability Software Market is increasingly influenced by the focus on enhancing customer experience. Airlines recognize that a positive customer experience is integral to retaining passengers and driving profitability. Software solutions that analyze customer preferences and feedback enable airlines to tailor their services and improve route offerings. Data indicates that airlines that prioritize customer satisfaction can see a revenue increase of up to 20%. This emphasis on customer-centric strategies is prompting airlines to invest in profitability software that not only tracks financial metrics but also integrates customer insights, thereby fostering growth in the Airline Route Profitability Software Market.

Regulatory Compliance and Reporting

The Airline Route Profitability Software Market is also driven by the need for regulatory compliance and accurate reporting. Airlines are subject to various regulations that require detailed reporting on route performance and financial metrics. This software assists airlines in maintaining compliance by providing comprehensive analytics and reporting tools. With the increasing scrutiny from regulatory bodies, airlines are investing in solutions that ensure transparency and accountability in their operations. Recent statistics indicate that airlines face penalties for non-compliance, which can significantly impact profitability. Therefore, the demand for robust profitability software that aids in regulatory adherence is likely to grow, further stimulating the Airline Route Profitability Software Market.

Shift Towards Dynamic Pricing Models

The Airline Route Profitability Software Market is witnessing a shift towards dynamic pricing models, which is reshaping how airlines approach revenue management. With the advent of sophisticated algorithms and real-time data analytics, airlines can adjust their pricing strategies based on demand fluctuations and market conditions. This adaptability is crucial in maximizing revenue and ensuring competitive pricing. Market analysis reveals that airlines employing dynamic pricing strategies can increase their revenue by approximately 15% compared to traditional pricing models. Consequently, the demand for software that supports these dynamic pricing mechanisms is on the rise, driving growth in the Airline Route Profitability Software Market.