Research Methodology on Airport Management Market

I. Introduction:

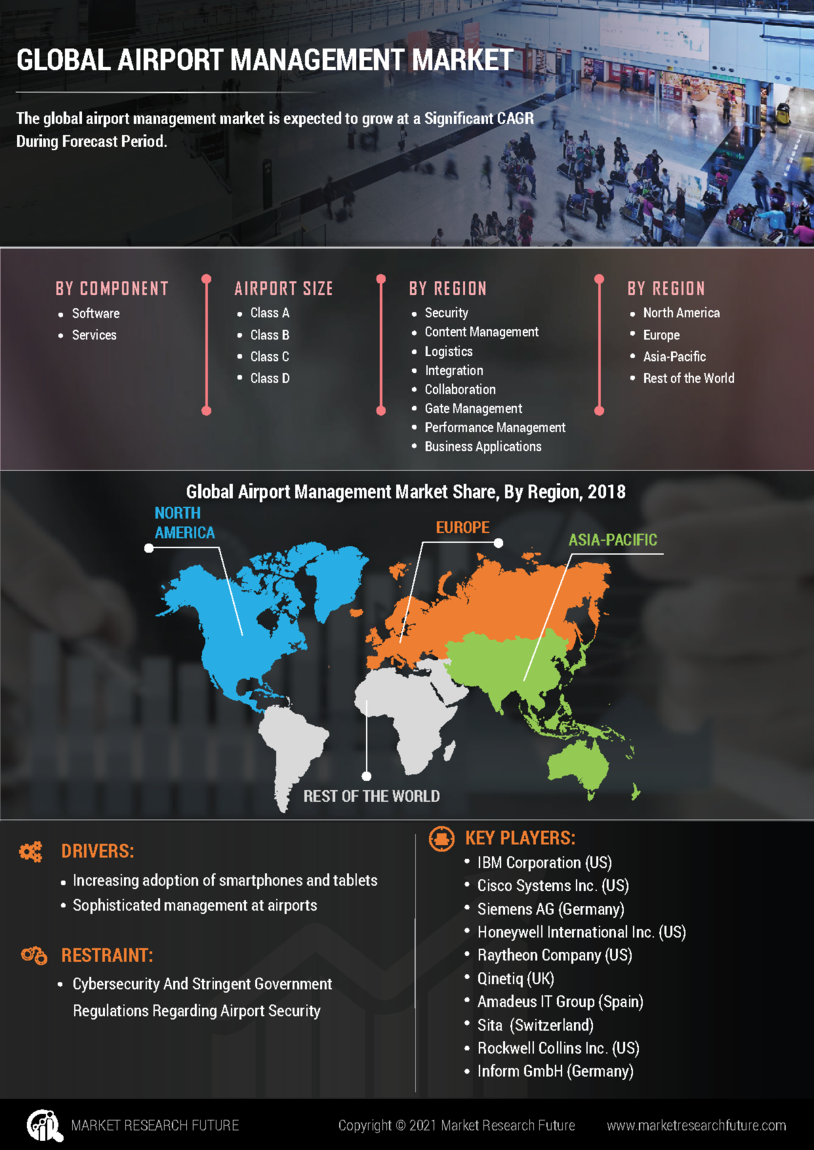

The global airport management market is projected to witness significant growth owing to a wide range of factors such as a rise in air traffic and increasing urbanization. The market research future (MRFR) report provides an in-depth analysis of the global airport management market. The research report is based on several factors, the primary being the scope, drivers, restraints, opportunities, trends and geographical coverage.

II. Objectives of the Study:

The primary objective of the research report is to provide a detailed overview of the airport management market. This includes studying the drivers and restraints which are expected to have an impact on the growth of the market over the forecast period from 2023 to 2030. Based on these observations, the market size, revenue and the various segments of the market have been studied.

III. Research Process and Type of Research Conducted:

This research report is written after conducting a detailed market analysis. Various data sources such as published articles, white papers, press releases, industry reports, news websites, and company annual reports have been used for gathering information and data points. The collected data has been verified by different sources such as industry specialists, experts, opinion leaders and senior executives.

IV. Primary and Secondary Data:

The data which has been obtained and analyzed primarily is known as the primary data. The primary data has been obtained after conducting several interviews with industry experts, opinion- leaders and senior stakeholders. Qualitative and quantitative primary research methods such as discussion, case studies and surveys have been employed for collecting the primary data.

V. Secondary data:

Secondary data such as books, magazines, industrial reports, newspaper articles, white papers, published websites, and reports were also consulted while conducting research. Other secondary sources include published statutes and online sources. Various search engines such as Google, Yahoo, Google Scholar, etc. have also been used for gathering secondary data. Various market players have also contributed secondary data for this research report.

VI. Global Market Assumptions:

The various assumptions considered for this research report include current trends in the industry, historical data, past events, the political scenario, technological advancements, and macro and micro-economic indicators. The data has been analyzed for trends and forecasts for the forecast period from 2023 to 2030.

VII. Research Scope:

The research scope includes a detailed analysis of the global Airport Management Market in terms of product type, application and geography. The research report also covers the impact of various factors that alter the market trend, such as regulations, technological advancements, and environmental factors. The study further breaks down the market into four major regions, namely North America, Europe, Asia-Pacific, and Rest of the world.

VIII. Segmentation of Global Airport Management Market:

The global Airport Management Market has been segmented into product type and application. By product type, the Airport Management Market has been divided into software, hardware, integrated solutions and others. By application, the Airport Management Market is segmented into aero structures, health and safety systems, surveillance systems, security systems and others.

IX. Data Validation and Triangulation:

Various validation processes have been conducted for ensuring the accuracy and validity of the collected data. The data points have been verified by conducting interviews with various industry experts and stakeholders. The collected data have also been triangulated to ensure the accuracy and validity of the data points.

XI. Conclusion:

The airport management market is projected to experience considerable growth over the forecast period 2023 to 2030, owing to an upsurge in air traffic and urbanization. The Airport Management Market is segmented into product type and application. This research report provides an overview of the global Airport Management Market in terms of its historical data points, current trends, and in-depth analysis of growth prospects.