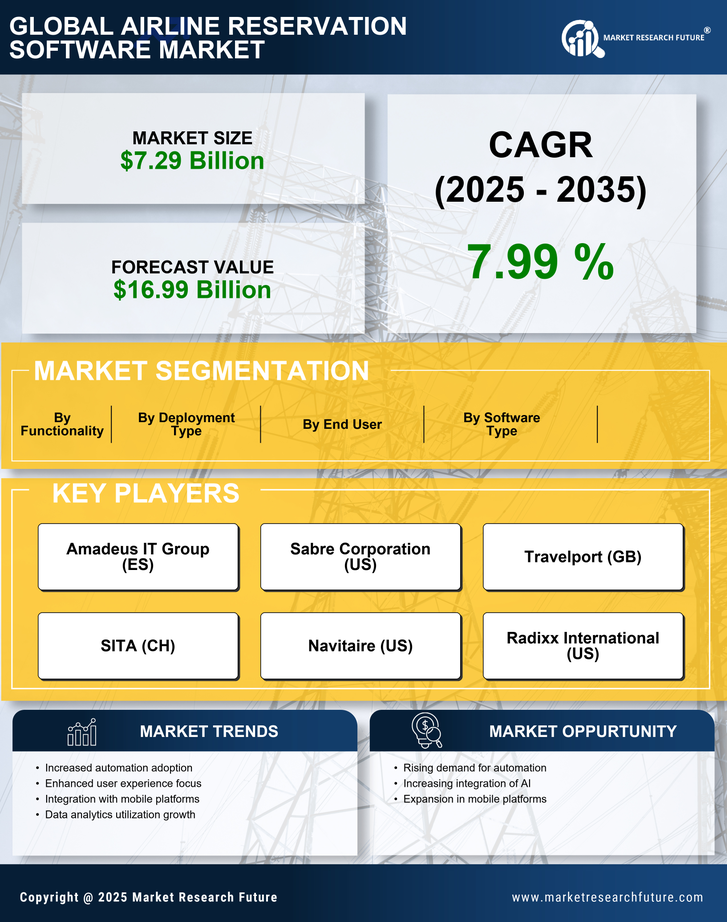

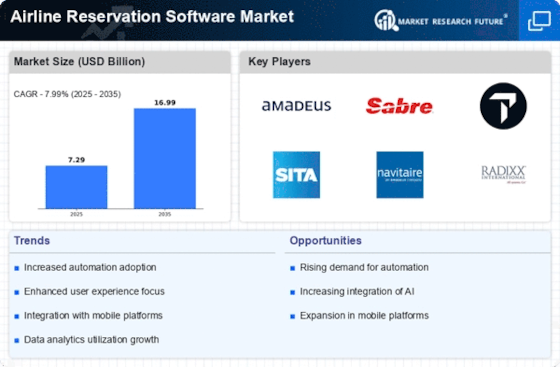

Rise in Travel Demand

The Airline Reservation Software Market is experiencing a notable surge in travel demand, driven by increasing disposable incomes and a growing middle class. As more individuals seek travel experiences, airlines are compelled to enhance their booking systems to accommodate this influx. The International Air Transport Association indicates that passenger numbers are projected to reach 8.2 billion by 2037, necessitating robust reservation systems. This demand compels airlines to invest in advanced software solutions that streamline operations, improve customer experience, and optimize revenue management. Consequently, the Airline Reservation Software Market is likely to witness substantial growth as airlines adapt to these evolving consumer preferences.

Technological Advancements

Technological advancements play a pivotal role in shaping the Airline Reservation Software Market. Innovations such as cloud computing, artificial intelligence, and machine learning are revolutionizing how airlines manage reservations. These technologies enable airlines to offer personalized services, enhance operational efficiency, and reduce costs. For instance, AI-driven chatbots are increasingly utilized for customer service, providing instant support and improving user experience. Furthermore, the integration of data analytics allows airlines to gain insights into customer behavior, leading to more effective marketing strategies. As these technologies continue to evolve, the Airline Reservation Software Market is expected to expand, driven by the need for more sophisticated and efficient reservation systems.

Emergence of Low-Cost Carriers

The emergence of low-cost carriers has transformed the Airline Reservation Software Market. These airlines often operate with leaner business models, necessitating efficient reservation systems that can handle high volumes of transactions at lower costs. The competitive landscape created by low-cost carriers compels traditional airlines to innovate and enhance their reservation systems to retain market share. This trend has led to increased investment in technology that supports dynamic pricing, real-time inventory management, and customer engagement. As low-cost carriers continue to gain popularity, the Airline Reservation Software Market is expected to grow, driven by the need for more efficient and cost-effective reservation solutions.

Growing Focus on Customer Experience

In the Airline Reservation Software Market, there is a growing emphasis on enhancing customer experience. Airlines are increasingly recognizing that a seamless booking process is crucial for customer satisfaction and loyalty. This realization has led to the development of user-friendly interfaces and mobile applications that facilitate easy access to reservation systems. According to industry reports, airlines that prioritize customer experience see a significant increase in repeat bookings. As competition intensifies, airlines are likely to invest more in software solutions that provide personalized experiences, thereby driving growth in the Airline Reservation Software Market. This focus on customer-centric solutions is expected to shape the future of airline reservations.

Regulatory Compliance and Data Security

The Airline Reservation Software Market is significantly influenced by regulatory compliance and data security concerns. With increasing regulations surrounding data protection, airlines must ensure that their reservation systems comply with legal standards. This necessity drives the demand for software solutions that incorporate robust security features to protect sensitive customer information. The General Data Protection Regulation and other similar frameworks have heightened awareness regarding data privacy, compelling airlines to invest in secure reservation systems. As a result, the Airline Reservation Software Market is likely to see growth as airlines prioritize compliance and security in their software investments.