North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Aircraft Weather Radar Systems MRO Services Market, holding a market size of $1.25B in 2025. Key growth drivers include increasing air traffic, stringent safety regulations, and advancements in radar technology. The region's robust infrastructure and investment in modernization further fuel demand, ensuring a steady growth trajectory. Regulatory support from agencies like the FAA enhances market stability and encourages innovation.

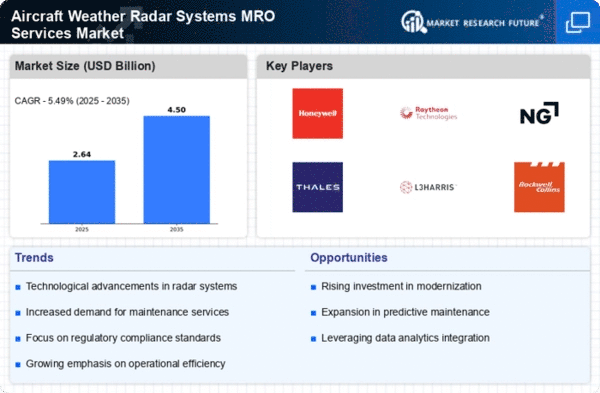

The competitive landscape is dominated by major players such as Honeywell, Raytheon Technologies, and Northrop Grumman, which are continuously innovating to meet evolving market needs. The U.S. leads the market, supported by a strong defense sector and commercial aviation growth. Canada also contributes significantly, focusing on enhancing its aviation safety standards. This competitive environment fosters collaboration and technological advancements, ensuring the region's continued dominance.

Europe : Emerging Market with Growth Potential

Europe's Aircraft Weather Radar Systems MRO Services Market is projected to grow, with a market size of $0.75B in 2025. The region benefits from increasing investments in aviation safety and modernization initiatives. Regulatory bodies like EASA are implementing stringent safety standards, which drive demand for MRO services. The focus on sustainability and reducing carbon emissions also propels the adoption of advanced radar technologies, enhancing operational efficiency.

Leading countries in this region include France, Germany, and the UK, where key players like Thales Group and Saab AB are actively involved. The competitive landscape is characterized by collaborations between manufacturers and service providers to enhance service offerings. The presence of established companies and a growing number of startups contribute to a dynamic market environment, positioning Europe as a significant player in the global MRO landscape.

Asia-Pacific : Rapidly Growing Aviation Sector

The Asia-Pacific region is witnessing rapid growth in the Aircraft Weather Radar Systems MRO Services Market, with a projected market size of $0.4B in 2025. Key growth drivers include increasing air travel demand, expanding airline fleets, and government initiatives to enhance aviation infrastructure. Countries like China and India are investing heavily in modernizing their aviation sectors, which is expected to boost MRO service demand significantly.

China leads the market in the region, supported by its vast commercial aviation sector and government policies aimed at improving safety standards. India is also emerging as a key player, with a growing number of airlines and a focus on enhancing operational efficiency. The competitive landscape features both established companies and new entrants, fostering innovation and collaboration to meet the rising demand for MRO services in this dynamic market.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region represents an untapped market for Aircraft Weather Radar Systems MRO Services, with a market size of $0.1B in 2025. The region is experiencing growth driven by increasing air travel, investments in aviation infrastructure, and a focus on enhancing safety standards. Governments are recognizing the importance of modernizing their aviation sectors, which is expected to create opportunities for MRO service providers in the coming years.

Leading countries in this region include the UAE and South Africa, where investments in aviation are on the rise. The competitive landscape is characterized by a mix of local and international players, with companies looking to establish a foothold in this emerging market. As the region continues to develop its aviation capabilities, the demand for MRO services is expected to grow, presenting significant opportunities for industry stakeholders.