Increasing Demand for Fuel Efficiency

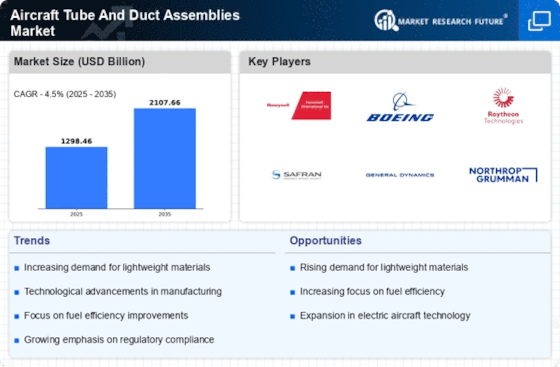

The aircraft tube and duct assemblies Market is experiencing a notable surge in demand for fuel-efficient aircraft. Airlines are increasingly focused on reducing operational costs, and fuel efficiency plays a pivotal role in this strategy. The integration of advanced tube and duct assemblies, which are designed to optimize airflow and reduce drag, is becoming essential. According to recent data, the aviation sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. This growth is likely to drive the need for innovative aircraft components, including tube and duct assemblies, which are critical for enhancing overall aircraft performance and efficiency.

Rising Demand for Commercial Aviation

The Aircraft Tube And Duct Assemblies Market is poised for growth due to the rising demand for commercial aviation. As economies recover and travel restrictions ease, passenger traffic is expected to increase significantly. This surge in demand for air travel is likely to lead to an expansion of airline fleets, thereby driving the need for new aircraft and, consequently, tube and duct assemblies. The International Air Transport Association (IATA) forecasts that passenger numbers will reach 8.2 billion by 2037, indicating a robust market for aircraft components. This trend suggests that manufacturers of tube and duct assemblies will need to scale production to meet the anticipated demand.

Regulatory Compliance and Safety Standards

The Aircraft Tube And Duct Assemblies Market is heavily influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-quality materials and manufacturing processes to ensure the safety and reliability of aircraft components. As airlines and manufacturers strive to meet these standards, the demand for advanced tube and duct assemblies is expected to rise. Compliance with safety regulations not only enhances the operational integrity of aircraft but also fosters consumer confidence in air travel. The increasing focus on safety is likely to propel the market for tube and duct assemblies, as manufacturers seek to provide compliant and reliable solutions.

Technological Advancements in Aerospace Engineering

Technological advancements are significantly influencing the Aircraft Tube And Duct Assemblies Market. Innovations in materials science and engineering techniques are leading to the development of more efficient and durable assemblies. For instance, the introduction of composite materials and advanced manufacturing processes is enhancing the performance and longevity of tube and duct assemblies. As a result, manufacturers are increasingly investing in research and development to create products that meet the evolving demands of the aerospace sector. The market for aerospace components is expected to reach USD 1 trillion by 2030, indicating a robust growth trajectory that will likely benefit the tube and duct assemblies segment.

Growth of the Aerospace Maintenance, Repair, and Overhaul (MRO) Sector

The Aircraft Tube And Duct Assemblies Market is benefiting from the growth of the aerospace maintenance, repair, and overhaul (MRO) sector. As the global fleet of aircraft expands, the need for regular maintenance and upgrades becomes paramount. MRO services are increasingly incorporating advanced tube and duct assemblies to enhance aircraft performance and extend service life. The MRO market is projected to reach USD 100 billion by 2026, driven by the rising number of aircraft in operation. This growth presents a significant opportunity for manufacturers of tube and duct assemblies, as they play a crucial role in the maintenance and enhancement of aircraft systems.