Rising Air Traffic

Technological Advancements

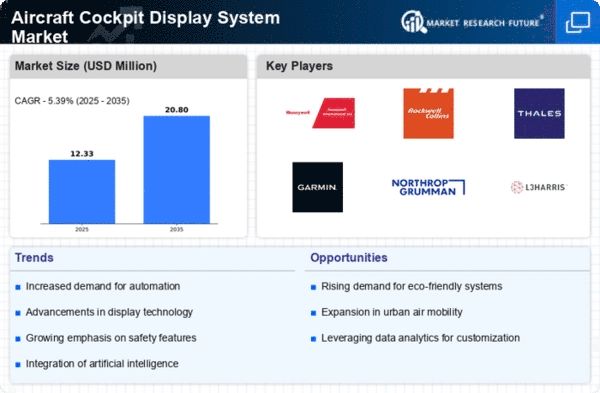

The Global Aircraft Cockpit Display Market Industry is experiencing rapid technological advancements, particularly in the integration of digital displays and enhanced user interfaces. Innovations such as head-up displays (HUDs) and multi-function displays (MFDs) are becoming increasingly prevalent, providing pilots with critical flight information in real-time. This trend is expected to drive the market significantly, as the demand for more intuitive and efficient cockpit systems rises. By 2024, the market is projected to reach 12.5 USD Billion, reflecting the growing emphasis on improving pilot situational awareness and operational efficiency. Such advancements are likely to enhance safety and performance in aviation.

Government Regulations and Standards

Government regulations and standards play a crucial role in shaping the Global Aircraft Cockpit Display Market Industry. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), are continuously updating safety and performance standards for cockpit displays. Compliance with these regulations often requires airlines and manufacturers to invest in advanced technologies, thereby driving market growth. As regulations become more stringent, the demand for sophisticated cockpit display systems that meet these requirements is likely to increase. This trend is expected to contribute to the market's expansion, particularly as new aircraft models are developed.

Increased Demand for Safety Features

Safety remains a paramount concern in aviation, propelling the Global Aircraft Cockpit Display Market Industry forward. Enhanced cockpit displays that provide better situational awareness and reduce pilot workload are increasingly sought after. Regulatory bodies are mandating advanced safety features, which include terrain awareness and warning systems (TAWS) and traffic collision avoidance systems (TCAS). As airlines and manufacturers prioritize safety, the market is expected to grow, with projections indicating a rise to 25 USD Billion by 2035. This growth underscores the industry's commitment to reducing accidents and improving overall flight safety through advanced cockpit display technologies.

Growing Demand for Retrofit Solutions

The Global Aircraft Cockpit Display Market Industry is witnessing a growing demand for retrofit solutions as older aircraft are updated with modern cockpit technologies. Airlines are increasingly investing in retrofitting existing fleets to enhance operational efficiency and comply with new regulations. This trend is particularly evident in regions with aging aircraft, where upgrading cockpit displays can significantly improve safety and performance. The retrofit market is expected to grow alongside new aircraft sales, providing opportunities for manufacturers to innovate and offer tailored solutions. As a result, the market is likely to benefit from this dual demand for both new and retrofitted cockpit display systems.